August 2021

Foreword

This handbook prescribes supplemental procedures in accordance with the federal regulations governing procurement, billing, and payment of passenger transportation services for the account of the U.S. government. Information in this handbook does not modify the regulations governing procurement, billing, passenger movement and payment of passenger transportation services.

In accordance with Public Law 105-264, October 19, 1998, the Travel and Transportation Reform Act of 1998, Section 2(a) under regulations issued by the Administrator of GSA after consultation with the Secretary of the Treasury, the Administrator shall require that federal employees use the travel charge card established by the United States Travel and Transportation Payment and Expense Control System, or any government travel charge card for all payments of expenses of official Government travel. The U.S. government transportation request, Standard and Optional Form 1169 may only be used in certain travel situations.

Careful application of this guide will result in greater efficiency in the procurement of transportation services for the government, improved transportation service provider services, and conservation of travel funds.

We prescribe regulations governing the use of travel documents that are published in 41 CFR 102-118. The application and impact of laws can vary widely based on the specific facts involved. Given the changing nature of laws, rules and regulations, and the inherent hazards of electronic communication, there may be delays, omissions or inaccuracies in information contained in this handbook. This handbook is published to aid in the compliance of applicable travel regulations.

Changes

This document has been substantially revised. Please review this document in its entirety.

This handbook prepared by Transportation Audits Division

Federal Acquisition Service (FAS),

General Services Administration 1800 F Street, NW Washington, DC 20405

www.gsa.gov/transaudits

Table of contents

Chapter 1: Introduction

- Selection of the method of transportation

- Methods of common TSP transportation an agency may authorize

- Methods of procuring passenger transportation services

- Method of payments:

- Use of contract city-pair fares

- Restrictions

- Mandatory terms and conditions governing the use of U. S. government passenger transportation documents

Chapter 2. Government travel charge card

Chapter 3. U.S. Government transportation request

- When to use GTR

- Description

- Obtaining GTRs

- Distribution and use

- The GTR may be used for government travel

- The GTRs may be used to purchase

- Multiple ticket purchases under single (blanket) GTRs

- Prohibitions

- The GTR shall NOT be issued

- Control and accountability

- Lost or stolen GTRs

- Canceled GTRs

- Disposing of spoiled, canceled, or unused GTRs

- Validation of GTRs

- Preparing the GTR

- Issuing office responsibilities

- Preparation, Issuance and distribution of the GTR

- Honoring of the GTR

- Lowest cost available fare

- GTRs for air service

- GTRs for rail service

- En route honoring of GTRs or rail and sleeping or parlor car services

- En route honoring of GTRs for sleeping or parlor car services only

- Rail service accommodation charges

- Honoring of GTRs by bus

- Where to get help

Chapter 4. Alternative methods of procuring passenger transportation

- Use of cash

- Unauthorized cash purchase of common TSP transportation

Chapter 5. Refunds

- General

- Time limitation

- Unused tickets or coupons unavailable

- Transportation service provider requirements

- Government agency responsibility

- Government agency responsibility to us

- Our responsibility

- Valid tickets for refund

- TSP Requirements for expired tickets for refund

- Refund or credit for unused transportation on an individually billed government charge card

- Agency processing of refunds for unused tickets purchased with centrally billed account

- Agency processing of refunds for unused tickets purchased with GTRs

- Miscellaneous charges order

- Refunds from foreign-flag TSPs

- Unused coupons for a flight between two common rated cities

- Tickets that are only partially refundable

- Tickets carrying cancellation penalties

- Round trip excursion fare tickets used only one way

- Standard Form 1170, Redemption of Unused Tickets

- Agency processing of Standard Form 1170 claims

Chapter 6. Compensation for denied boarding and vacating seat voluntarily

- Denied boarding

- Voluntarily surrendering seat

Chapter 7. Use of foreign-flag TSPs

- Background

- U.S. flag-certificated service - “available”/ “unavailable”

- Certification statement

- Employee liability for disallowed expenditures

Chapter 8. Payment and submission of transportation bills to gsa

- Payment of transportation bills

- Submit paid transportation bills for postpayment audit

Glossary of terms

Sample forms

Chapter 1. Introduction

Passenger Transportation Services Furnished for the Account of the United States Government in accordance with 41 CFR 102-118.190

Selection of the method of transportation

Federal Travel Regulation, 41 CFR 301-10.4 requires agencies to select the method of transportation most advantageous to the government, when cost and other factors are considered. Under 5 U.S.C. 5733, travel of an employee must be by the most expeditious and cost effective means of transportation practicable and commensurate with the nature and purpose of the employee’s official duties.

Methods of common transportation an agency may authorize

- Airline

- Train

- Ship

- Bus

- Rental car

Methods of procuring passenger transportation services

Public Law 105-264, Section 2(a) states that the Administrator of GSA, after consultation with the Secretary of the Treasury, shall issue regulations requiring that federal employees use the travel charge card established pursuant to the U.S. Travel and Transportation Payment and Expense Control System, or any federal travel charge card, for all payments of expenses of official government travel. Public Law 105-264, Section 2(a) also provides conditions for government travel card usage exemption. Public Law 105-264, Section 2(b) says that the head of the federal agency or designee may exempt any payment, person, type or class of payments, or type or class of agency personnel from subsection (a) if the agency head or the designee determines the exemption to be necessary in the interest of the agency. No later than 30 days from granting such an exemption, the head of such agency or the designee shall notify the Administrator in writing of such exemption stating reasons for the exemption. Cash should be used only to pay for those expenses which, as a general rule, cannot be charged. In accordance with FTR sections 301-51.100, 301-51.101, and 301- 72.3(d) government transportation request is an acceptable method of payment when no other option is available or feasible, however, its use must be documented by the head of the federal agency.

Such services, regardless of the procurement method specified by the agency, must be procured directly from either a travel management company or a travel agent. For the purposes of this handbook the term “travel management service” refers to a travel management company, commercial travel office, and may also refer to an electronically available system, other commercial methods of arranging travel, or an in-house system per FTR 300-3.1. A travel agent may be used only as prescribed in the FTR or applicable regulations of the Department of Defense.

Government agencies must require travelers to use TMCs for all common TSP arrangements unless an exemption is granted under 41 CFR 301-50.3.

Method of Payments

- Government travel charge card

- Individually billed account

- Centrally billed account

- Government transportation request

- Alternative methods

- Checks, both personal and travelers (including those obtained through a travel payment system services program).

- Cash withdrawals using a GTCC

- Personal charge card

Agency heads or their designees may specify which of these government-provided methods of payment, or combination thereof, travelers will use to procure official passenger transportation services. Reference 301.51.100

Note: U.S. government airfares require payment via GTCC or GTR only. Cash may only be used to pay for transportation expenses in extreme circumstances when other forms are not an acceptable form of payment.

Use of contract city-pair fares

Contract city-pair carriers must always be used if such city-pair fares are available, except as stated in 41 CFR 301-10.107.

Restrictions

Issuing officers and travelers must adhere to the regulations requiring the use of certificated air carriers, when available, for travel on official business. Expenditures for service furnished by a foreign flag TSP generally will be allowed only when service by a U.S. flag certificated air carrier, in accordance with 49 U.S. Code Chapter 447, is “unavailable”. (41 CFR 301- 10.135) See Chapter 7 for details.

Mandatory terms and conditions governing the use of U. S. government passenger transportation documents

- The U.S. government will not be responsible for charges exceeding those applicable to the transportation or accommodations of the type, class, or character authorized in passenger transportation documents.

- The issuing official, by their signature, certifies that the requested transportation is for official business.

- Government travel must be via the lowest cost available which meets travel requirements. U.S. government passenger transportation documents must be used to authorize all official travel expenses.

- Mandatory terms and conditions governing the use of passenger transportation documents are defined in 41 CFR 102-118.150.

- Policies pertaining to travel authorization should be referred to your agency or designee for specific guidance. See (41 CFR 301-2.1).

Notice of overcharge for air TSPs

Audit of contract fares by our Transportation Audit Division

- The government shall conduct audits of transportation bills from a carrier in accordance with 31 U.S.C. § 3726 and Federal Management Regulation (FMR) Part 102-118 (41 CFR 102-118).

- Prior to the postpayment audit, the contract carrier may voluntarily reimburse the ordering activity by the amount of any money due the government. This should be done through the normal refund process associated with the travel card contractor, or directly to the ordering agency’s finance office when other payment means are used. The contract carrier shall maintain documentation of this refund.

- Interest shall accrue from the voucher payment date on overcharges made hereunder and shall be paid at the same rate in effect on that date as published by the Debt Collection Improvement Act of 1996.

Chapter 2. Government travel charge card

The U.S. government implemented a travel charge card program called “GSA SmartPay.” The SmartPay program issues government travel charge cards and are branded as either VISA or MasterCard cards. The current travel charge card contract, known as “SmartPay 3,” became effective November 28, 2018.

The government travel charge card, when authorized, should be used to the maximum extent possible for official travel expenses (41 CFR 301-51.7 and 41 CFR 301-51.100). GTCCs are issued with unique prefixes and account numbers. The current charge card contract known as SmartPay3 became effective November 28, 2018. The government travel charge card is widely accepted for all modes of transportation. Official travel should be purchased using the GTCC, individually billed account or centrally billed account or the Integrated card or the new Tax Advantage travel cards as shown below.

Note: The new Tax Advantage travel charge card is issued for tax exemption of rental vehicles and hotel charges only but can be utilized for the purchase of transportation services.

Tax advantage travel card

The following guidance is to be used with regards to SP3 travel cards. It explains the bank identification numbers and how to identify authorized and non-authorized users of the City Pair Program. This information will assist with the filing of fares and form of payment for the FY21 City pair Program awards and beyond.

The first four prefix numbers listed below are the bank identification numbers for Visa and MasterCard Prefixes (Association Prefixes) that identify the card as a government SP3 charge card for your designated fare rules. The approved SP3 BINs for travel are found below:

Additionally, the fifth digit of the account number identifies whether the cardholder is an authorized or non-authorized user of CPP contract.

The sixth digit of the account number identifies whether the user holds a CBA or IBA and whether it is a mandatory or non-mandatory user of a CPP contract, or any combination of the two. Specifically referenced is Section C.3.3.6.1.1. of the SP3 master contract: Table 8 shows the SP3 GSA CPP account numbering sequences for GSA SmartPay travel accounts.

[1] Examples of appropriate use: Agencies/organizations that are not eligible for GSA City Pair 1

GSA city pair program account numbering sequences for GSA SmartPay travel accounts

- Fifth digit

- 0, 1, 2, 3, 4, 5 = Authorized use of GSA City Pair Program

- 6, 7, 8, 9 = Not authorized to use GSA City Pair Program (no access to GSA City Pair Program)8

- Sixth digit

- 0 = CBA, non-mandatory GSA City Pair Program

- 1 = IBA, mandatory to GSA City Pair Program

- 2,3, 4 = IBA, mandatory to GSA City Pair Program

- 5 = IBA/CBA, Tax Advantage (Tax exemption is not applicable to taxes charged on airfare/City Pair rates)

- 6, 7, 8, 9 = CBA, mandatory to GSA City Pair Program

Examples of CBA, non-mandatory GSA city pair appropriate use:

- Agencies/organizations that are not eligible for GSA City Pair Program contract fares

- Accounts issued to contractors

- Any fares purchased by the government for contractors

- Other categories of travelers that are not authorized access to GSA City Pair Program contract fares. This applies to Sixth Digit “0”

Note: Applies #1 sixth digit nonmandatory users GSA City Pair Program - The new Tax Advantage card is issued for tax exemption of rental vehicle and hotel charges only, but can be utilized for the purchase of transportation services.

For additional information on the SmartPay program visit the SmartPay website at: https://smartpay.gsa.gov/ or contact the General Services Administration, SmartPay Program support via email at gsa_smartpay@gsa.gov or via telephone at 703-605-2808.

NOTE: TMCs should not be the merchant for airline tickets. GTCC or GTR is an acceptable form of payment. TMC can be a merchant for ticketing transactions fees.

Chapter 3. U.S. government transportation request

When to use GTR

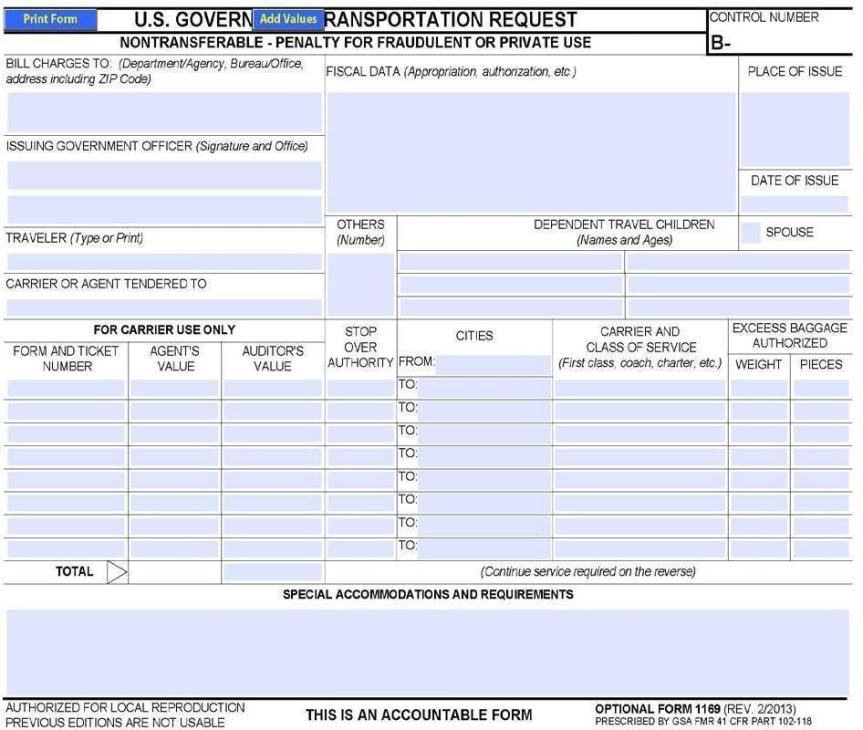

Optional Form 1169 U.S. Government Transportation Request is used to procure passenger transportation services for the account of the government (see 41 CFR 301- 51.100) when a GTCC cannot be used.

Purpose of the GTR

The GTR is designed to meet the requirements of the government and the transportation industry and serves as:

- Control - a standard accountable document.

- Certification - official travel only.

- Procurement authorization - listing of transportation services requested.

- Contract of carriage - between the government and the TMC upon which it is drawn.

- Notice of conditions - governing the transaction.

- Billing support document - provides evidence of actual services furnished.

- Accounting and fiscal document - for obligation and liquidation of funds payable to TMCs.

- Audit document - records passenger transportation services requested and furnished.

Description

The GTR, OF 1169, has replaced the SF 1169, the blue paper document, which is no longer printed. The OF 1169 is a form for federal employee use only. Agencies may send an e-mail to forms@gsa.gov to request copies of the form. OF 1169 is available electronically only. Use of this form without an assigned control number is not allowed and cannot be paid. Agencies should dispose of all SF1169 forms in accordance with disposition instructions identified later in this chapter. This includes unused forms, which should be destroyed.

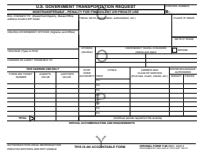

Figure 1 Optional Form 1169, U.S. Government Transportation Request

Obtaining GTRs

- Request for blank GTRs should be sent to the address or email provided below. Provide the following information with your request:

- Agency point of contact

- Title

- Email

- Phone number

- Mailing address

- Activity Address Code (AAC)

- Form requested (OF 1169)

- number of serial numbers needed.

General Services Administration

Federal Acquisition Service

Southwest Supply and Acquisition Center

Technical Services and Commodity Branch (7QSBBB)

819 Taylor Street, Room 6A00

Fort Worth TX 76102- 6124

or send an e-mail to forms@gsa.gov

Distribution and use

The individual GTR form is distributed as follows:

- OF 1169, the original GTR confirms the services or accommodation requested and is given to the TMC. The form contains conditions and instructions for the contract of transportation; a description of services authorized; and the signature, which is the certification, of the issuing officer. The OF 1169 along with travel orders are used to support the TSP’s bill for transportation charges.

- Copies are used for internal fiscal accounting purposes and distributed as directed by the regulations of the user agency.

The GTR may be used to bill for government travel:

- Via air, rail, or bus

- Via inland water and ocean TSPs only if special circumstances justify

- Between points within the U.S. and any other country

- Between points outside the U.S.

The GTR may be used to bill to purchase:

- Tickets and/or transportation for individual or group travel.

- Quantities of tickets or tokens under the bulk purchase plan.

- Tickets issued under blanket arrangements covering definite periods of time.

- Charter, contract, tender, or quotation services.

Multiple ticket purchases under single (blanket) GTR

Federal agencies must sign agreements with TMCs in order to use blanket GTRs. Under the provisions of these agreements, a blanket GTR is issued at the beginning of each calendar week or other payment period, mutually agreed upon by the agency and the TMC, to cover all tickets issued during the period, not to exceed one month. A list must be maintained to show the number and value of each ticket issued under the blanket GTR, as well as other information essential to agency and TSP fiscal requirements.

Completely unused tickets procured on a previously paid blanket GTR and all partially unused tickets shall be redeemed under the procedures utilizing SF 1170 (see Chapter 5).

Prohibitions

The GTR shall NOT be issued:

- After a service has been performed

- As a duplicate

- To procure individual passenger transportation services costing $10 or less, exclusive of transportation tax (unless justified by special circumstances).

- To procure air excess baggage service costing $15 or less for each leg of a trip (unless justified by special circumstances).To procure individual taxicab, airport limousine, intra-city transit, rental vehicle, or other for-hire vehicle service.

- To pay for toll road or toll bridge charges.

- To obtain transportation services not required for official business, including unauthorized extra-fare trains or planes, stopovers, and indirect routings. The GTR shall be issued only for the portion of the transportation expenses properly chargeable to the government. Charges for services other than those authorized must be borne by the traveler and collected by the TSP or TMC.

Control and accountability

Agencies shall maintain accountability records, physical control of remaining GTRs booklets, if applicable, and assigned GTR serial numbers. Effective physical control should include storage of GTR stock in a locked container or locked storage room. NOTE: Assigned GTR serial numbers should be afforded the same protection/safekeeping as actual GTR booklets by agency guidance. Employees responsible for the issuance and use of GTR forms shall be held accountable for their disposition. Travelers or those who are accountable are responsible for the custody of tickets and other transportation documents received in exchange for GTRs or other procuring instruments. Failure to safeguard such documents may result in personal liability, of the traveler or those who are accountable, if unauthorized persons use tickets or documents.

Lost or stolen assigned GTR serial numbers

The person that is accountable must report a lost or stolen GTR serial number promptly, in writing, to the appropriate agency office. If the lost or stolen GTR shows the TMC, service desired, and point of origin, then the TMC must also be notified promptly in writing. A GTR serial number reported as lost or stolen but subsequently recovered must not be used under any circumstances. The word “CANCELED” should be marked on the face of the GTR and it should be forwarded immediately through the issuing office to the office maintaining accountability records.

Canceled GTR serial number

A GTR serial number that is spoiled during preparation, canceled, or prepared for issuance but not used should be marked “CANCELED” across the face and forwarded at once through the issuing office to the office maintaining accountability records.

Disposing of spoiled, canceled, or unused GTR serial numbers

GTR serial numbers spoiled in preparation, canceled, or otherwise unused, should be returned to the office in each agency that maintains accountability of these forms.

The accountable office must provide a list of the GTR numbers which are spoiled, cancelled, or otherwise unused to:

General Services Administration

Federal Acquisition Service Southwest Supply and Acquisition Center Technical Services and Commodity Branch (7QSBBB)

819 Taylor Street, Room 6A00

Fort Worth TX 76102- 6124.

After the Technical Services and Commodity Branch has been notified and confirmed receipt to the sender that the GTR numbers have been received and then the numbers may be destroyed or disposed of in accordance with applicable regulations.

The National Archives and Records Administration provides instructions for the retention and disposal of GTRs in General Records Schedule 1.1 https://www.archives.gov/files/records-mgmt/grs/grs01-1.pdf.

Validation of GTRs

TMCs must:

- Not honor a GTR that is incomplete, unsigned, or show alterations that have not been initialed by the issuing officer.

- Require that the GTRs be completely filled out and properly signed by the issuing officer so as to be valid for presentation to obtain transportation services and/or accommodations.

- Require the person presenting a valid GTR to establish his identity as the traveler or the party authorized to receive the ticket, exchange order, refund slip, or other transportation document. In the absence of satisfactory identification, the TSP will not honor the GTR.

- Not accept the memorandum copy (OF- 1169-A) of the GTR in lieu of the original (OF 1169).

Preparing the GTR

Issuing office responsibilities

A GTR must be completely and properly filled out and signed by the issuing officer because:

- TMCs will not honor a GTR, which is incomplete, unsigned, or shows erasures or alterations that are not initiated by the issuing officer.

- An improperly executed GTR compromises an agency’s ability to perform a technical audit of the paid GTR and pursue any overcharge claims on behalf of the government.

- Entries other than signatures should be typed whenever possible or printed in ink. It is essential that the carbon impressions of entries be clear and easily readable on all copies.

- A GTR must be prepared and given to the TMC in exchange for each ticket. If a blanket GTR is used to purchase multiple tickets issued during a designated payment period, the GTR must be given to the TMC prior to issuance of the first ticket. Since the GTR is both a procurement document and a contract document, issuing officers are prohibited from giving only a GTR number to the TMC in lieu of an actual GTR.

- Government travel must be via the lowest cost fare available, which meets travel requirements. The lowest cost fare available is the one for which the traveler meets all conditions. The issuing officer must assure that a request is conveyed to the TSP or its agent; for the lowest cost, fully refundable coach fare available, by entering the term “lowest coach” in “CARRIER (TSP) AND CLASS OF SERVICE” (block 12) on the GTR. If the specific fare basis is known, it should also be entered in the “CARRIER (TSP) AND CLASS OF SERVICE” block of the GTR.

Preparation, Issuance and distribution of the GTR

Honoring of the GTR

The federal agency will provide the GTR number to the TMC who in turn will use the GTR number as the form of payment when issuing the airline tickets. This number, printed in the form of a payment box of the airline ticket, gives the TMC authority to sell U.S. government fares. The TMC pays the airline for the ticket and will invoice the federal agency to recover their funds.

Lowest cost available fare

The annotation “lowest coach” placed on the GTR means lowest cost coach fare within policy. Unless the GTR expressly specifies otherwise, TSPs and their agents must provide the government traveler with the lowest cost coach fare available within policy, which meets traveler requirements when issuing a ticket in exchange for a GTR.

GTRs for air service

OF 1169 is issued and used only for officially authorized passenger transportation for the account of the U.S. government. GTRs may be used to pay for international air travel. For domestic air travel, GTRs may be used under special circumstances and for travel related expenses. Special domestic circumstances are defined as acts of God, emergency situations, and when purchasing a domestic ticket in the U.S. in conjunction with travel that originated overseas.

GTRs for rail service

All Common Carrier transportation over $100.00 must be procured by a GTCC or GTR.

Also please refer to DTR Part 105 and Defense Travel Management Office rail program guidance.

Honoring of GTRs by bus

Please refer to DTR Part 104 [PDF] and Defense Travel Management Office bus program guidance.

Where to get help

Questions concerning preparation and processing of GTRs should be directed to your agency’s travel or transportation office.

Department of Defense (DoD) travelers should contact their local transportation offices. Transportation Officers should direct questions to their area command or refer to the Defense Transportation Regulation (DTR) Part 1, Appendix L, para. E.

Chapter 4. Alternative methods of procuring passenger transportation

Use of cash

Travelers must comply with the rules in 41 CFR 301-51.100 through 301-51.103 that limit the use of cash. One of the following payment methods to procure common TSP transportation is considered the equivalent of cash and you must comply with the rules in 41 CFR 102-118.50 that limit the use of cash for such purposes (41 CFR 301-51.101):

- Personal credit cards;

- Cash withdrawals obtained from an ATM using a Government individually billed travel card; and

- Checks, both personal and travelers (including those obtained through a travel payment system services program).

For passenger transportation services costing:

- $10 or less, and air excess baggage charge of $15 or less for each leg of a trip

- More than $10, but not more $100

- More than $100

Travelers must use a government individually billed travel card, centrally billed travel card, or GTR to procure contract passenger transportation services. In reference to (b), above, cash may only be used when none of the other methods are practicable. In reference to (c) above, your agency authorizes you to use a reduced fare for group, charter, or excursion arrangements; or under emergency circumstances where the use of other methods is not possible. (See 41 CFR 301-51.100 and 41 CFR 301-51.101).

Unauthorized cash purchase of common TSP transportation

If you are a new employee or an invitational or infrequent traveler who is unaware of proper procedures for purchasing common TSP transportation, your agency may allow reimbursement for the full cost of the transportation. In all other instances, your reimbursement will be limited to the cost of such transportation using the authorized method of payment (41 CFR 301-51.102) (JTR 020207A Reimbursement for Commercial Transportation).

Note: U.S. Government airfares must be purchased with a GTCC or GTR only. Cash is not an acceptable form of payment for these fares.

Chapter 5. Refunds

General

The following circumstances result in unused passenger transportation documents:

- Tickets are purchased for government travel but are never used;

- Travel is terminated short of the authorized destination;

- The return portion of a round-trip ticket is not used; or

- Services actually furnished are different or of a lesser value than those authorized and the GTR cannot be so endorsed.

All adjustments in connection with official passenger transportation must be promptly processed to prevent losses to the government. Therefore, as soon as possible, the government traveler must submit all unused tickets, including portions thereof, miscellaneous charge orders/electronic miscellaneous document , ticket refund applications, notices of fare adjustments, etc., and a full report of the circumstances to your agency in accordance with your agency’s procedures for recovery of refunds due the government. That office is usually the one that paid the TSP or travel management company for the tickets issued to the traveler, the office that processes the traveler’s travel reimbursement voucher, or the office that issued the GTR. If a traveler is uncertain as to where to submit unused tickets, contact their ordering issuing authority.

Unused tickets have monetary value government travelers should always be instructed to return all unused or partially unused tickets to their agency for processing as a refund due the government. Under no circumstances should unused or partially unused tickets be filed, destroyed, or thrown away!

Time Limitation

Effective 22 May 2008, Public Law 110-234 SEC. 14219. Elimination of Statute of Limitations Applicable to Collection of Debt by Administration Offset. (a) Elimination—Section 3716(e) of title 31, United States Code, is amended to read as follows: ‘‘(e)(1) Notwithstanding any other provision of law, regulation, or administrative limitation, no limitation on the period within which an offset may be initiated or taken pursuant to this section shall be effective.” This means that there is no time limit for collected ordinary debts via administrative offset. Application of interest on the amount above is calculated from thirty (30) days after the original mailing of the SF 1170 “Notice of Indebtedness.”

Unused tickets or coupons unavailable

Lacking unused tickets or coupons as evidence of the unfurnished services, the traveler or person in charge of the group of travelers shall obtain written acknowledgement of the situation from the TSP’s representative for submission with their report. If transportation and/or accommodations are furnished for a lesser number of persons than specified on a party ticket, the TSP’s conductor or ticket collector shall note on the ticket or coupon the number of persons actually transported and the number and type of accommodations furnished.

Transportation service provider requirements

Upon presentation of proper documents as specified in this chapter, the contract carrier shall fully and promptly refund all unused and partially unused portions of any government contract fare ticket to the activity paying for the ticket, the travel management company issuing the ticket, or the individual traveler, as appropriate. If the contract carrier does not refund the government on unused or partially unused tickets prior to expiration, then Transportation Audits may seek to recover all monies due to the government.

Refund checks should be made payable to the U.S. Treasury and sent to:

General Services Administration

Government Lock Box 979006

1005 Convention Plaza

St. Louis, MO 63101.

Government Agency Responsibility

Each government agency must ensure that timely internal controls are in place to collect refunds for unused or partially used airline tickets for federal employees who have purchased airfare, consistent with existing requirements in:

A government agency must establish administrative procedures with their travel management companies for tracking, reporting and collecting refunds on valid unused, partially used, and exchanged tickets. The procedures must provide the following:

- Written instructions explaining traveler responsibility and liability for the value of tickets issued until all ticket coupons are used or properly accounted for on the travel voucher;

- Instructions for submitting payments received from TSPs for refund of valid unused / partially used tickets;

- The traveler with a “bill charges to” address so that the traveler can provide this information to the TSP for returned or exchange tickets.

- Procedures for promptly identifying any unused tickets, coupons, or other evidence of refund due the government.

Timely reporting on a routine basis to obtain valid unused ticket refunds

Government agencies through their TMC’s should process unused tickets with the TSP(s) on a routine and timely basis. This will ensure refunds are returned to the agency/organization funding the travel. Refunds will be requested through the TMC’s automated refund process or issued on a Standard Form 1170 directly to the carriers. Information will include:

- Agency information (name, office symbol, address, POCs)

- Ticket number(s)

- Original form of payment: SmartPay Charge card or GTR number

- Original ticket price

- Ticket purchase date

- Routing information

- Airline carrier’s SCAC code

- Requested refund amount

- Refund date

- Administrative fees/penalties in accordance with fare rules (if applicable)

Government agency responsibility to the Transportation Audits Division

To receive our support with refunds for (non-expired) unused tickets, agencies may submit unused ticket reports and/or SF1170 information via email to unusedticket-reports@gsa.gov. The following information should be provided:

- Agency information (name, office symbol, address, POCs)

- Ticket number(s)

- Original form of payment: SmartPay Charge card or GTR number

- Original ticket price

- Ticket purchase date

- Routing information

- Airline carrier’s SCAC code

- Requested refund amount

- Refund date

- Administrative fees/penalties in accordance with fare rules (if applicable)

Our audits responsibility

The Transportation Audits Division will assist government agencies with tracking and collecting refunds from TSP(s) for non-expired unused, partially used, and exchange tickets. On a quarterly basis, we will submit electronic requests for refund information for all federal agencies to the TSP’s for refund.

The Division will execute administrative procedures for collecting refunds from TSPs for expired unused tickets within 90 days after expiration. On a quarterly basis, the Division will submit electronic requests from the government agencies for refund to TSPs for the current value of all expired (unused) tickets in accordance with CFR 102-118.

The Division may enter into an agreement with the TSP(s) to automatically refund unused/partially used tickets back to the government. This will be accomplished on a quarterly basis whereby the TSP will review all unused CPP tickets and automatically refund the unused or partially used ticket amount back to the government. All other commercial fared tickets are processed as requested and refunded as the fare rules apply. (See also Transportation Service Provider Requirements for the processing of refunds.)

Valid tickets for refund

Government agencies should solicit refund services from their travel management company to automatically request refunds directly from the TSP carrier for any fully unused or partially used tickets. The TMC should provide in accordance with the contract an unused ticket report of all ticket refund requests to ensure refunds have been requested and to track timeliness of refunds and reconciliation of charges back to the government agency funding organization via the IBA/CBA.

- Travel management companies have in place automated / electronic processes and resources for identifying and addressing unused electronic tickets.

- The automated Unused Electronic Ticket system searches for canceled reservations of electronic tickets and those are sent to the TMC system for faster processing and reporting. The UET checks status every four hours which improves daily refund processing and notification of unused non-refundable tickets for tracking.

- The TMC quality control process that audits Airline Reporting Corporation transactions verifies ticket usage. Once unused tickets are identified, refunding through the Global Distribution System, Integrated Airline Reporting process is relatively simple and recorded. Partially used tickets require a calculation of the residual value.

- Refunds are transmitted through ARC’s IAR process of reporting sales and refunds.

TSP requirements for expired tickets for refund

Tickets which cannot be processed through the UET and are no longer valid for refund to the government funding agency/organization will then be processed through the Division for refund.

TSPs shall refund the value of unused tickets (after expiration), even if they do not receive a refund request/SF 1170 from a government agency or TMC. Upon request from the Division, TSPs will make such refunds within 90 days after the date of request. The refund information shall include:

- Ticket number(s)

- GTR number (if applicable)

- Original ticket price

- Ticket purchase date

- Routing information

- Airline carrier’s SCAC code

- Refund amount

- Refund date

- Administrative fees in accordance with fare rules (if applicable)

- Form of payment

Refund Checks should be made payable to the U.S. Treasury and sent to:

General Services Administration

Government Lock Box 979006

1005 Convention Plaza

St. Louis, MO 63101.

Refund or credit for unused transportation on an individually billed government charge card

The traveler must submit any unused ticket coupons, unused e-tickets, or refund applications to your agency in accordance with your agency’s procedures (41 CFR 301-10.114).

Any charges billed directly to an individually billed government charge card should be credited back to that account (41 CFR 301-10.115). TSP should coordinate with the issuing TMC and government agency to recoup any monies owed to the government.

Agency processing of refunds for unused tickets purchased with centrally billed account and/or GTR

- Downgraded/exchanged ticket coupons

- Obtain airline receipt from traveler showing credit is due agency.

- Confirm unused portion of downgraded/exchanged ticket coupon has been credited to agency CBA.

- Partially unused tickets

- Obtain partially unused ticket from traveler and return it to the TMC that furnished the airline ticket.

- Obtain a receipt from the TMC showing a credit is due the agency.

- Confirm that the value of the partially unused ticket has been credited to agency CBA.

- Unused tickets for travelers

- Obtain unused ticket or notification from traveler and return it to the federal agency office or TMC that furnished the airline ticket. Federal agency verifies unused ticket is identified on Unused Ticket Report.

- Obtain acknowledgement of notifying TMC of unused ticket credit is due to the agency.

- Confirm that the value of the unused ticket has been credited to the agency GTCC.

- If the airline has failed to credit the agency GTCC or offer a satisfactory explanation within 30 days, the government agency notifies the Division to take action against the airline to collect the debt under the Federal Claims Collection Standards including administrative offset, if necessary.

Miscellaneous Charges Order

MCOs (also known as Electronic Miscellaneous Document) are an airline transaction for a non-ticket purchase, such as an insurance payment or excess baggage fee. MCOs are issued by airlines and are similar to old-style airline tickets. TMCs should not issue MCOs for exchanged, downgraded, or unused tickets purchased with GTRs. Some TSPs occasionally issue MCOs erroneously. The following procedures apply if an airline inadvertently issues an MCO to a government traveler on official business:

- An MCO issued against an original ticket purchased with a GTR should be returned to the fiscal office or designated agency official responsible for handling unused tickets.

- MCOs submitted with travel vouchers should be attached to the front of the vouchers. The traveler should annotate on the voucher that an MCO is attached.

- Agencies shall issue a SF 1170 for an MCO and process it in the same manner that the SF 1170 is processed for an unused ticket purchased with a GTR (see instructions on page 51).

- If an MCO is issued for a cash purchase or for a ticket purchased with a Government employee charge card, the traveler is responsible for obtaining the refund. The MCO should be returned to the issuer of the original ticket and processed for refund in the same way that an unused ticket is processed for a refund.

Partially refundable tickets

Tickets carrying cancellation penalties

Certain types of fares carry penalties for change or cancellation, once the ticket is issued. If penalties apply, an indication that the tickets are subject to penalties: Advance purchase fares (those requiring purchase a specified number of days prior to departure) may be subject to penalties ranging anywhere from 10% to 50% of the total fare paid. Tickets carrying such penalties may be refunded, minus whatever cancellation fee applies.

Round trip tickets used one way

In situations where unrestricted round trip fare tickets are used only one way, the unused portion of the ticket should be returned to the TMC. The refund amount due for these tickets is governed by each airline’s tariff rules concerning voluntary and involuntary refunds, denied boarding compensation, airline penalties, and surcharges. The refund amount due on unused excursion fare coupons must be calculated on a case-by-case basis.

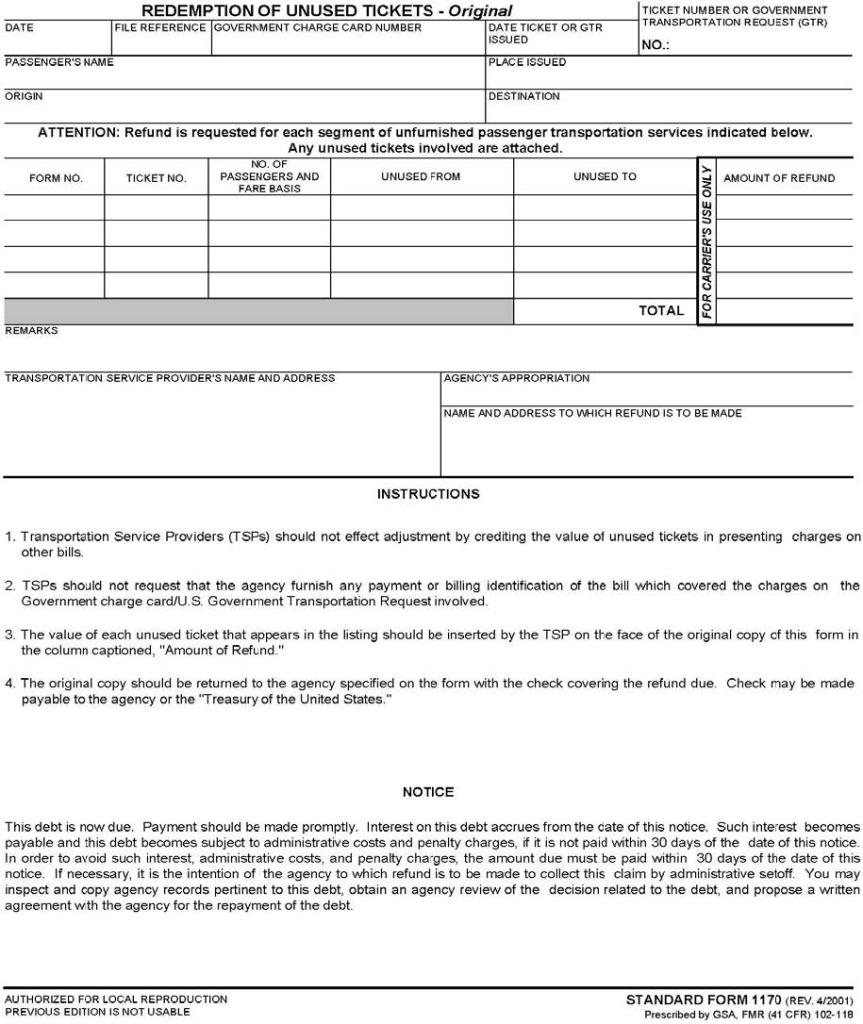

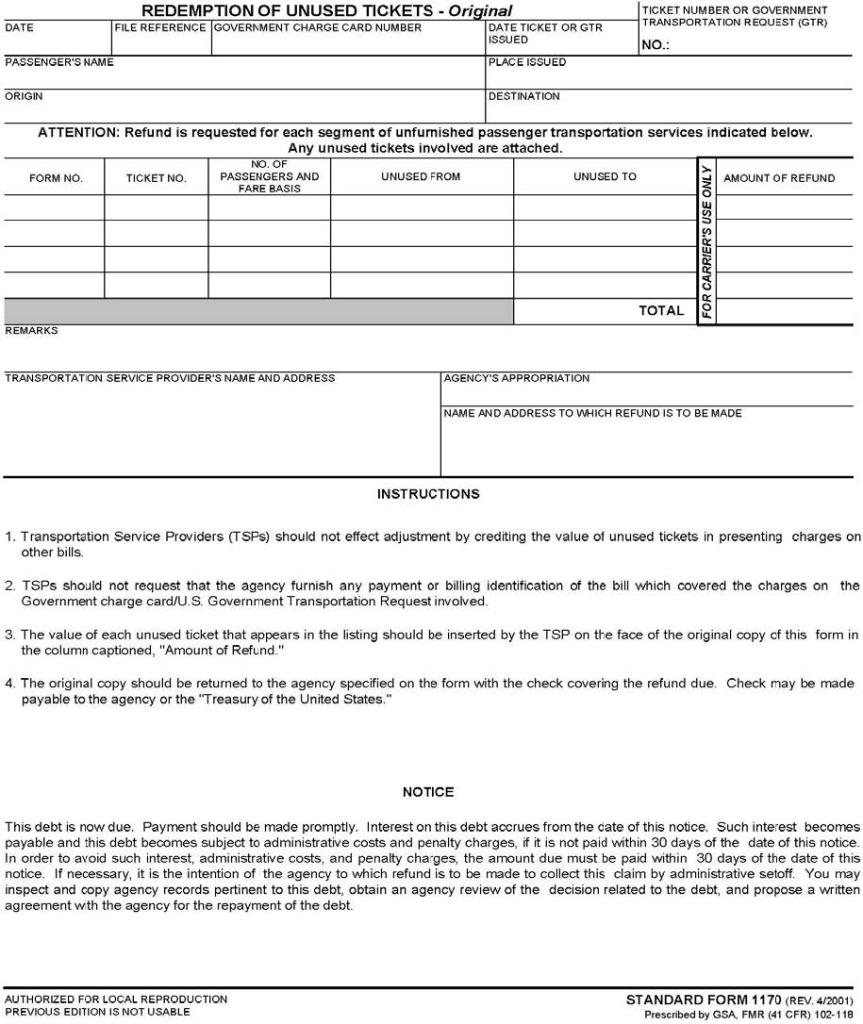

Redemption of unused tickets

Agencies shall not revise TSP bills or require TSPs to rebill items. Agencies shall demand the refund value of unused tickets from TSPs through the use of a SF 1170, Redemption of Unused Tickets. A separate SF 1170 must be prepared for each GTR, though more than one ticket or adjustment transaction may be related to that GTR. Each ticket must be listed on SF 1170.

Standard Form 1170 [PDF, 302kb]can be obtained electronically.

Agency processing of SF 1170 claims

Timely processing of SF 1170 is essential to facilitate prompt refunds from TSPs. Agencies and TMC provider processing SF 1170 shall ensure that:

- All copies clearly show the required details.

- The original and the duplicate copy, together with pertinent unused ticket numbers, are promptly forwarded to the TSP.

- All other copies are retained by the agency for accounting control.

Chapter 6. Compensation for denied boarding and vacating seat voluntarily

Guidance for denied boarding compensation and vacating a seat voluntarily can be found on GovInfo. Additional guidance on denied boarding compensation can be found online and Department of Transportation’s pamphlet Fly-Rights, A Guide to Air Travel.

Denied boarding

If you are performing official travel and a carrier denies you a confirmed reserved seat on a plane, you must give your agency any payment you receive for liquidated damages. You must ensure the carrier shows the “Treasurer of the United States” as payee on the compensation check and then forward the payment to the appropriate agency official (41CFR 301-10.116).

Voluntarily Surrendering Seat

When travelers voluntarily surrender their seat; at the request of scheduled airlines, they may only be compensated:

- If voluntarily vacating your seat will not interfere with performing your official duties; and

- If additional travel expenses, incurred as a result of vacating your seat, are borne by the traveler and are not reimbursed; but

- If volunteering delays your travel during duty hours, your agency will charge you with annual leave for the additional hours (41 CFR 301-10.117)

Chapter 7. Use of foreign-flag TSPs

Background

Travelers are required by the Fly America Act, to use U.S.-flagged airlines for all air travel funded by the U.S. government. One exception to this requirement is transportation provided under a bilateral or multilateral air transport agreement, Open Skies Agreements, to which the U.S. government and the government of a foreign country, such as the EU are parties, and which the Department of Transportation has determined meets the requirements of the Fly America Act.

4 CFR 52.2(a) prescribes guidelines on the use of American flag vessels and certificated air carriers. Issuing officers and travelers must adhere to the regulations requiring the use of certificated air carriers, when available, for travel on official business. Expenditures for service furnished by a foreign flag TSP generally will be allowed only when service by a U.S. flag certificated air carrier is unavailable. (4 CFR 301-10.135) Each voucher covering any expenditures involving foreign-flag ocean or foreign-flag air passenger transportation must be supported by a certificate or memorandum as to the unavailability of U.S. flag service. This should be signed by a responsible official of the agency that authorized the travel or transportation or by the traveler who has knowledge of the facts concerning usage.

Defining available/unavailable U.S. flag certificated service

Generally, passenger service by a U.S. flag air TSP is available if the TSP can perform the commercial foreign air transportation needed by the agency and if the service will accomplish the agency’s mission. Expenditures for service furnished by a foreign-flag air TSP generally will be allowed only when service by an U.S. flag air TSP is considered unavailable. For a full explanation see:

Certification statement

The certificate supporting a voucher involving foreign flag ocean or foreign flag air service shall read substantially as shown in the following:

I certify that it is/was necessary for ___ (Name of traveler or agency) ___ to use, or to transport

personal effects/freight on, ___ (Foreign-flag vessel(s) or air TSP(s) (flight identification #(s)) ___

between _____________ and _____________

en route from ______________ to _____________

on, ___(Date)___ for the following reasons: ____

____________________________________________________________

____________________________________________________________

____________________________________________________________

Date ________ Signature of traveler or authorizing officer title or position ____________________________

Organization ______________________________________

Employee liability for disallowed expenditures

You will not be reimbursed for any transportation cost for which you improperly use foreign air carrier service. If you are authorized by your agency to use U.S. flag air carrier service for your entire trip, and you improperly use a foreign air carrier for any part of or the entire trip (i.e., when not permitted under this regulation), your transportation cost on the foreign air carrier will not be payable by your agency. If your agency authorizes you to use U.S. flag air carrier service for part of your trip and foreign air carrier service for another part of your trip, and you improperly use a foreign air carrier (i.e., when neither authorized to do so nor otherwise permitted under this regulation), your agency will pay the transportation cost on the foreign air carrier for only the portion(s) of the trip for which you were authorized to use foreign air carrier service. The agency must establish internal procedures for denying reimbursement to travelers when use of a foreign air carrier was neither authorized nor otherwise permitted under this regulation (FTR 301-10.143).

Chapter 8. Payment and submission of transportation bills to our audit

Payment of transportation bills

All transportation bills are subject to the provisions of the Prompt Payment Act and must establish a prepayment audit program, unless the Administrator has granted a waiver. All correct and properly documented bills must be paid upon completion of transportation service.

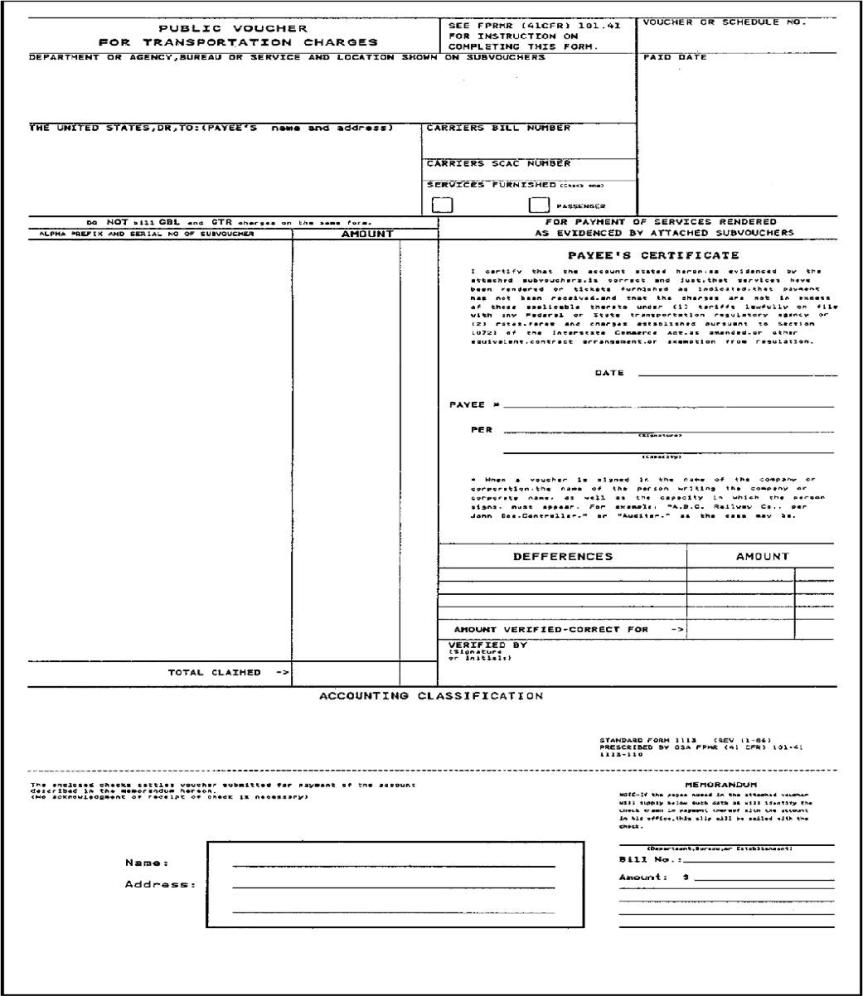

Prior to payment, agencies must examine TSP’s bills to ensure that:

- The Standard Carrier Alpha Code (SCAC) and the taxpayer identification number is entered on each SF 1113 and SF 1113-A. If the SCAC and TIN is omitted, the forms and all supporting papers shall be returned to the TSP unpaid with a request that they be added to the forms.

- The transportation services for which payment is claimed were duly authorized, that such services represent a legal obligation under the appropriation or fund involved, that the TSP’s bill is complete and supported with required documentation, and that all extensions and computation of charges are correct.

- No duplicate payments are made. Procedures and controls must be established to prevent duplicate payments, to recover any duplicate payments that may be made, and to perform an annual review of effectiveness of those procedures.

- The TSP is provided with a notice of an apparent error, defect, or impropriety within seven days of receipt of an invoice.

Submit paid transportation bills for postpayment audit

Agencies must forward copies of their paid transportation bills and all supporting documents to the Transportation Audits Division through the transportation audits management system each month for post-payment audit (41 CFR 102-118.425).

NOTE: Agencies are encouraged to use the Division-approved third party electronic payment processor for transportation invoice processing, payment, and prepayment audit. If your agency utilizes a third-party payment system or charge card company that includes prepayment audit functions, such as U.S. Bank Syncada, you can provide the Division system access to eliminate forwarding paid transportation bills and all supporting documents. Providing access will ensure your agency is fully compliant with the Division’s prepayment and postpayment audit requirements. This effort allows the Division to fully execute their congressionally mandated responsibility to perform postpayment audits of all agencies’ transportation bills.

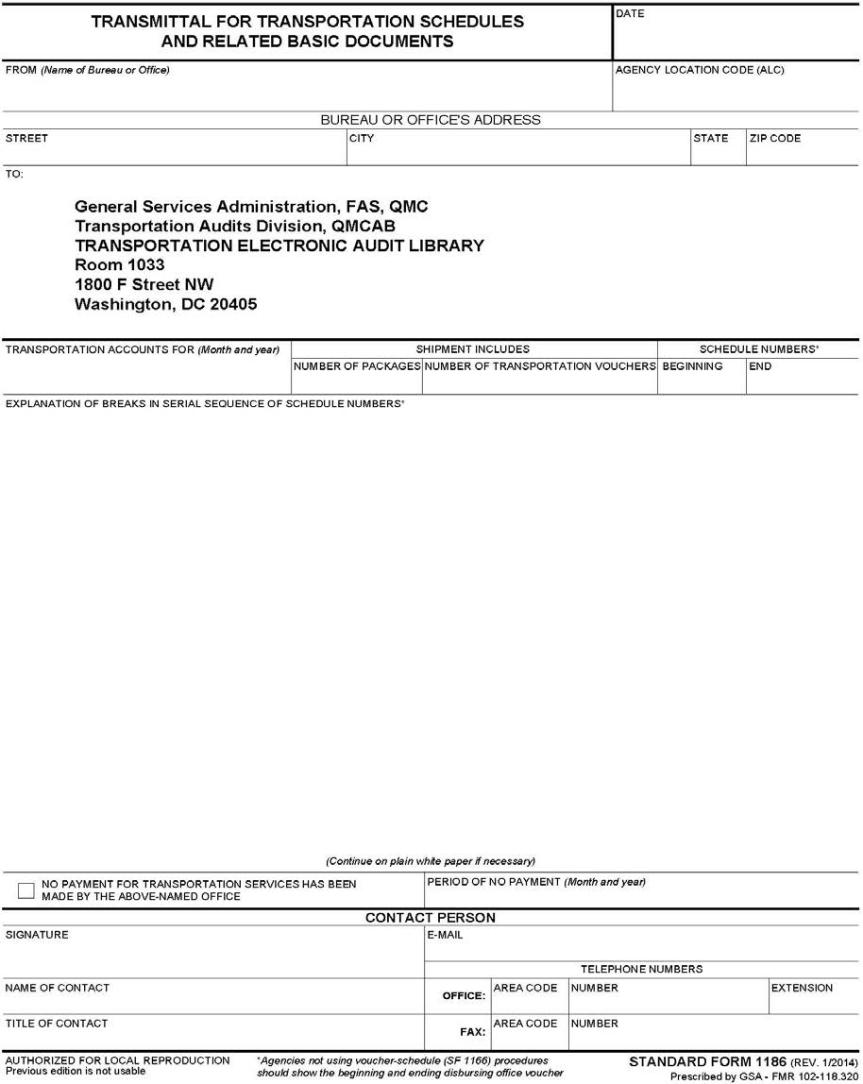

The following forms are used:

Submit paid bills at the end of each account month: avoid multiple account month submissions. Paid bills should be submitted to the Division at the end of each account month. If, due to an administrative oversight, this is not done, and it becomes necessary to submit multiple account months at the same time,

- the most recent account month should be forwarded in a separate package,

- all prior account months should be bundled by month, each with an accompanying SF 1186 and should be forwarded in one package clearly marked as to its contents.

Ensure that each SF 1113 contains the paid date.

- Identify delayed/withheld vouchers - Any transportation vouchers that have not been paid because they are doubtful claims must be identified on a separate SF 1186 and forwarded to Transportation Audits Division (QMCA).

- Submit negative reports - If no SF 1113s are paid during the month, check the block in the lower left corner of the SF 1186 and submit to Transportation Audit Division, QMC.

Glossary of terms

Agency: Any department or establishment of the federal government defined by 5 U.S.C. 305 whose payment for transportation services are subject to the transportation audit provisions of section 322 of the Transportation Act of 1940, as amended (31 U.S.C. 3726).

Airline ticket: A negotiable hardcopy or electronic document issued by an air TSP or their agents for passage on a flight or flights by designated TSP.

ARC (Airline Reporting Corporation): Members of the Air Transport Association are the stockholders of ARC. The purpose of ARC is to provide a method of approving authorized agency locations for the sale of transportation. ARC is responsible for the domestic airline and travel agency area settlement plan.

Automated teller machine (ATM): A machine provided by a participating bank which allows cash withdrawals within established dollar limits to be charged to an issued card

Authorization: The process of verifying that a purchase being made is within the authorization controls at the point of sale.

Baggage: Government property and personal property of the traveler necessary for the purposes of official travel.

Centrally billed account (CBA): A card/account established by the contractor at the request of a participating agency. These may be card/card less accounts. Payments are made directly to the contractor by the agency.

Charge card: An IBA/CBA contractor-issued charge card to be used by travelers of a participating agency to pay for passenger transportation services, subsistence expenses, and other allowable travel and transportation expenses incurred in connecting with official travel.

Churning: Is defined as cancelling and/or rebooking the same flight, class, date and route, in order to circumvent the ticketing time limit. Churning violations risk PNR corruption and excessive GDS costs incurred due to churning will be billed back to agents via Agent Debit Memos (ADMs) due to excessive cancellation. The GDS has OSI entries to turn off ticketing time limits for U.S.G. fares.

City pair contractors: GSA has entered into contracts with TSPs flying between certain cities where frequent government travel is performed.

Commercial travel office (CTO): A Department of Defense travel arranger known as a travel management company. This office provides a full range of travel services for the DOD traveler. The CTO may be staffed with DOD personnel or may be a commercial travel agency.

Common carrier: See transportation service provider.

Contract carriers: U.S. certificated air TSPs that are under contract with the government to furnish federal employees and other persons authorized to travel at government expense with passenger transportation service. This also includes city pair scheduled airline passenger service between selected U.S. cities/airports and between selected U.S. and international cities/airports at reduced fares.

Electronic data interchange (EDI): Electronic techniques for accomplishing transportation transactions by means of electronic transmission of the information in lieu of the creation of a paper document.

Excess baggage: Baggage in excess of the weight, number of pieces or size that is carried without incurring an extra charge by transportation companies.

Fly America Act: Federal travelers are required by 49 U.S.C. 40118, to use U.S. air carrier service for all travel and cargo transportation services funded by the U.S. government.

Foreign flag vessel: A vessel of foreign registry including vessels owned by U.S. citizens but registered in a nation other than the U.S.

Foreign flag air TSP: An air TSP who is not holding a certificate issued by the U.S. under 49 U.S.C. 41102.

Global distribution system (GDS): Is a computerized, centralized service that provides travel-related transactions.

Government travel charge card (GTCC): An individually billed account or centrally billed account.

Government transportation document: Any executed agreement for transportation service, such as bill of lading, government bill of lading (GBL), government travel request (GTR) or transportation ticket.

Government transportation request (GTR) (Optional Form 1169): A government document used to purchase transportation services. The document obligates the government to pay for transportation services provided.

Government travel regulation: Rules governing the travel and relocation allowances and entitlement of federal employees performing official travel or relocating for the government.

- For federal civilian employees, see the Federal Travel Regulation (41 CFR Chapters 301-304).

- For members of the Uniformed Services, see Joint Travel Regulations.

- For members of the Foreign Service of the United States; see Chapter 500 Volume 14 of the Foreign Affairs Manual .

Individually billed account (IBA): A contractor issued card used by travelers of a participating agency/organization to pay for passenger transportation service, subsistence expenses, and other travel expenses incurred in connection with official travel.

Integrated airline reporting (IAR): ARC’s IAR is an electronic sales reporting system for travel agents and CTDs that facilitates the settlement of sales, refunds, exchanges, and memos.

Miscellaneous charge order (MCO): A document issued by TSPs for excess baggage, denied boarding compensation, unused tickets, or for refunds due because of rerouting, downgrading, or change in class of service. MCOs are a negotiable document.

Official travel: Travel performed at the direction of a federal agency under an official travel authorization.

Open Skies: Open Skies agreements between the U.S. and other countries expand international passenger and cargo flights by eliminating government interference in commercial airline decisions about routes, capacity and pricing. This frees carriers to provide more affordable, convenient and efficient air service to consumers, promoting increased travel and trade and spurring high-quality job opportunity and economic growth. Open Skies policy rejects the outmoded practice of highly restrictive air services agreements protecting flag carriers.

Passenger transportation document (PTD): GTR, tickets, MCO, or any fully executed agreement for transportation services.

Taxpayer identification number (TIN): A taxpayer identification number assigned by the Department of Treasury.

Ticket refund application: A document or receipt issued by the TSP for a refund due as a result of a change of routing, class of service, or cancellation of a flight. Ticket refund application can also be referred to as Transportation Refund Application or Transportation Credit.

Ticketing time limits for USG fares: Time limits are stated in the airline’s fare rule. The GSA City Pair program currently states when reservations are made at least three days prior to departure, ticketing is required at least two days prior to departure. If reservations are made less than three days before departure, ticketing is required at least six hours prior to departure.

Transportation service provider (TSP): Any party, person, agency or carrier who undertakes by contract or agreement to provide transportation services to the federal government.

Transportation service: Services involving the physical movement of people, products, and any or all objects from one location to another by a TSP for the federal government.

Travel management company (TMC): A manner to arrange travel services for federal employees on official travel, including reservation of accommodations and ticketing. A TMC includes a commercial ticket office, electronic travel management system, or other commercial method of arranging travel.

Unused electronic ticket (UET): When utilized - Unused e-ticket is an easy, user- friendly, interactive GDS tool that informs TMCs that the traveler has unused electronic tickets that notifies and applies to the current travel reservation booking that a ticket is unused.

U. S. flag air carrier service: Service provided by an air TSP that holds a certificate under 49 U.S.C. 41102 and which services are authorized either by the carrier’s certificate or by exemption or regulation. U.S. flag air carrier service also includes service provided under a code share agreement with a foreign air carrier in accordance with Title 14, Code of Federal Regulations when the ticket, or documentation for an electronic ticket, identifies the U.S. flag air carrier’s designator code and flight number.

U. S. flag vessel: A government vessel or a privately owned U.S. flag commercial vessel registered and operated under the laws of the U.S. used in commercial trace of the U.S., owned and operated by U.S. citizens including a vessel under voyage at time of charter to the government and a government-owned vessel under bare boat charter to and operated by U.S. citizens.

Sample forms

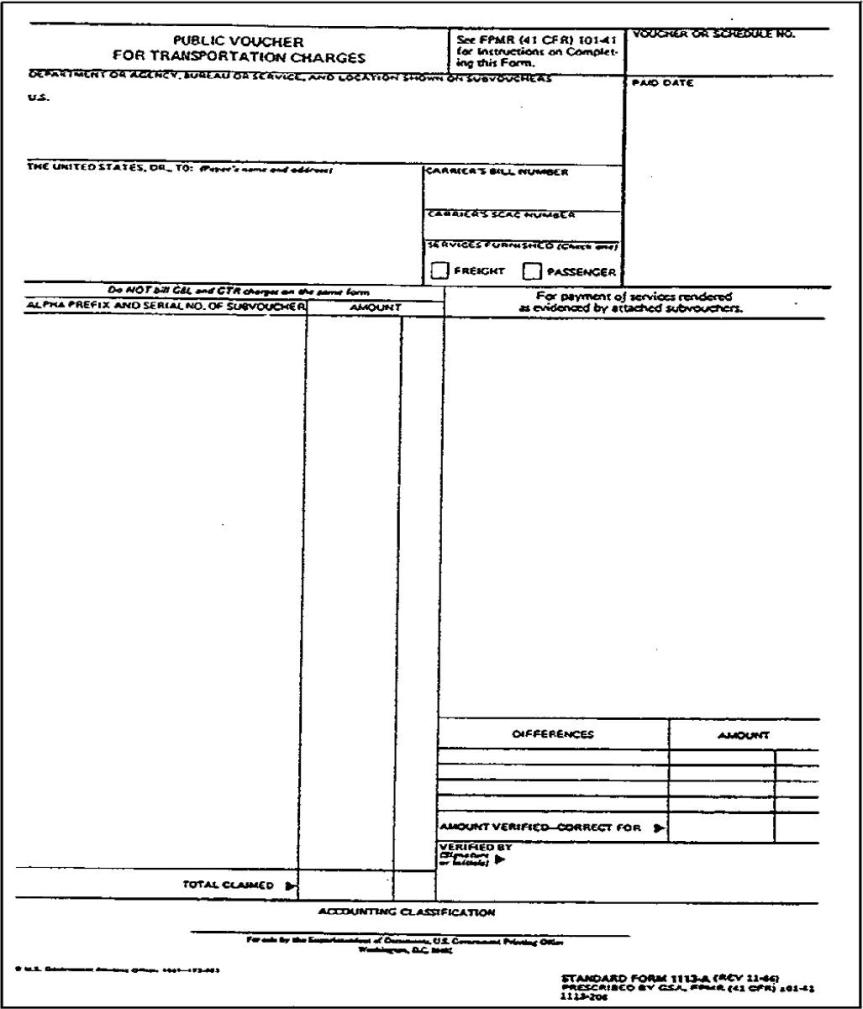

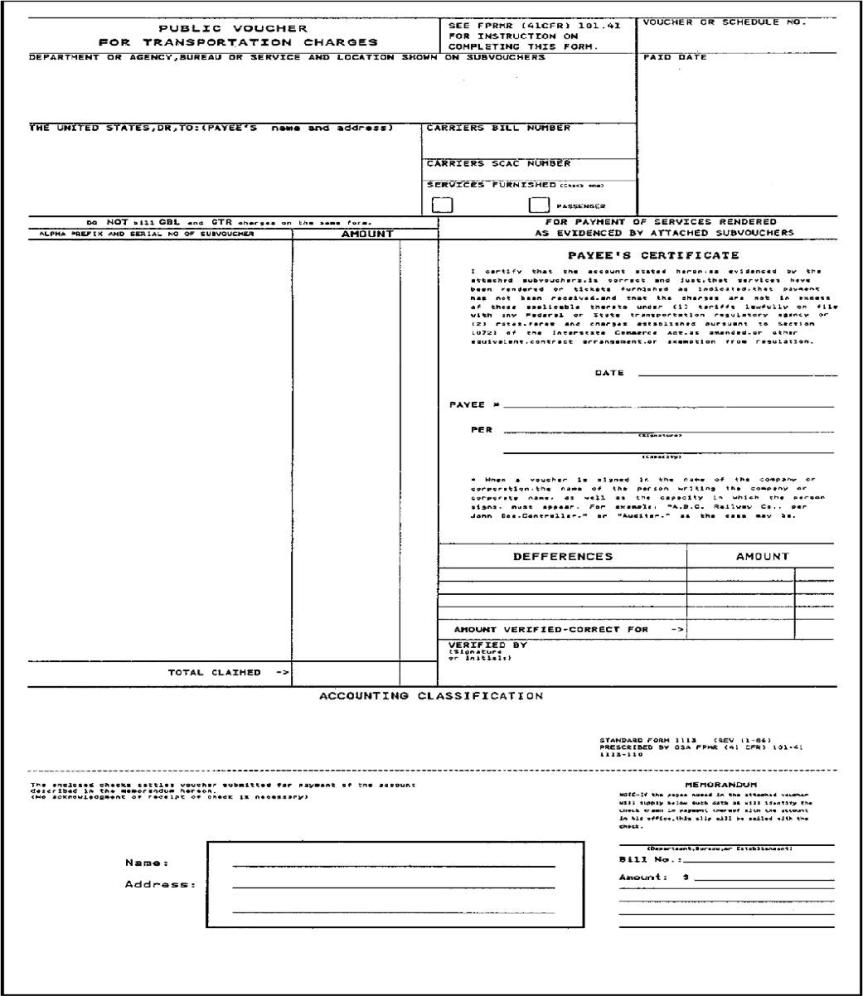

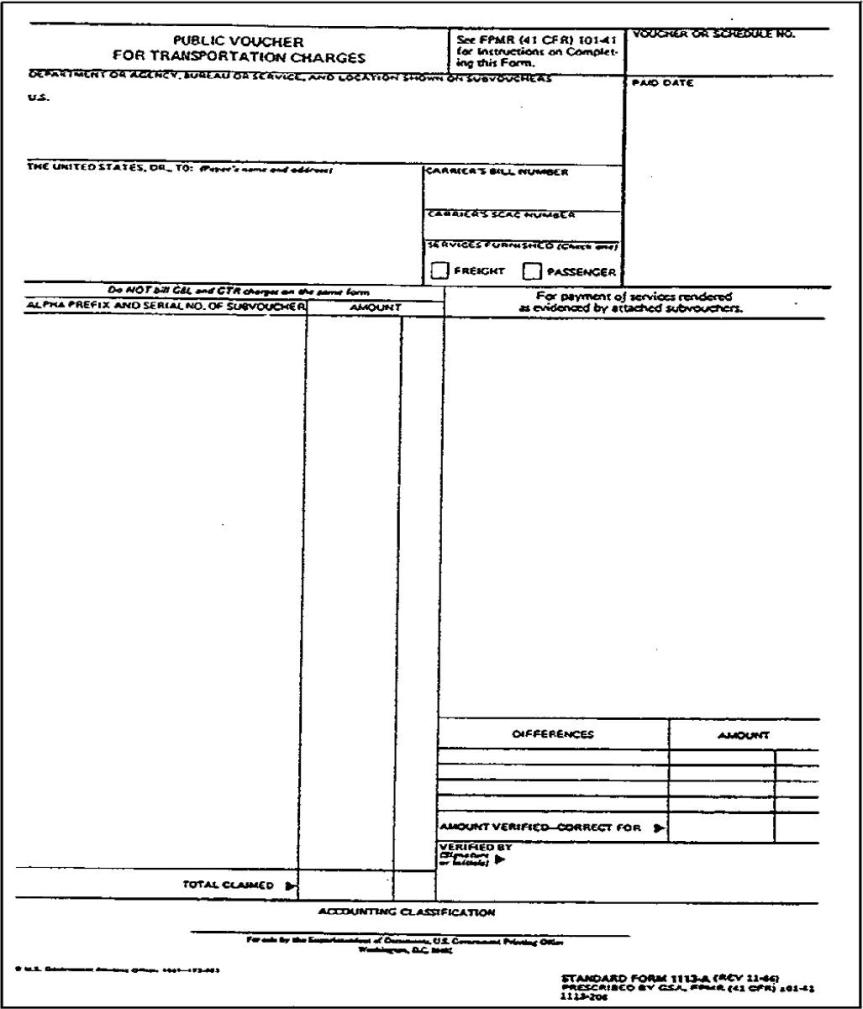

Figure 23 SF 1113-a, public voucher for transportation charges (memorandum copy) page 1

Figure 23 SF 1113-a, public voucher for transportation charges (memorandum copy) page 2

Figure 28 sf 1170, redemption of unused tickets

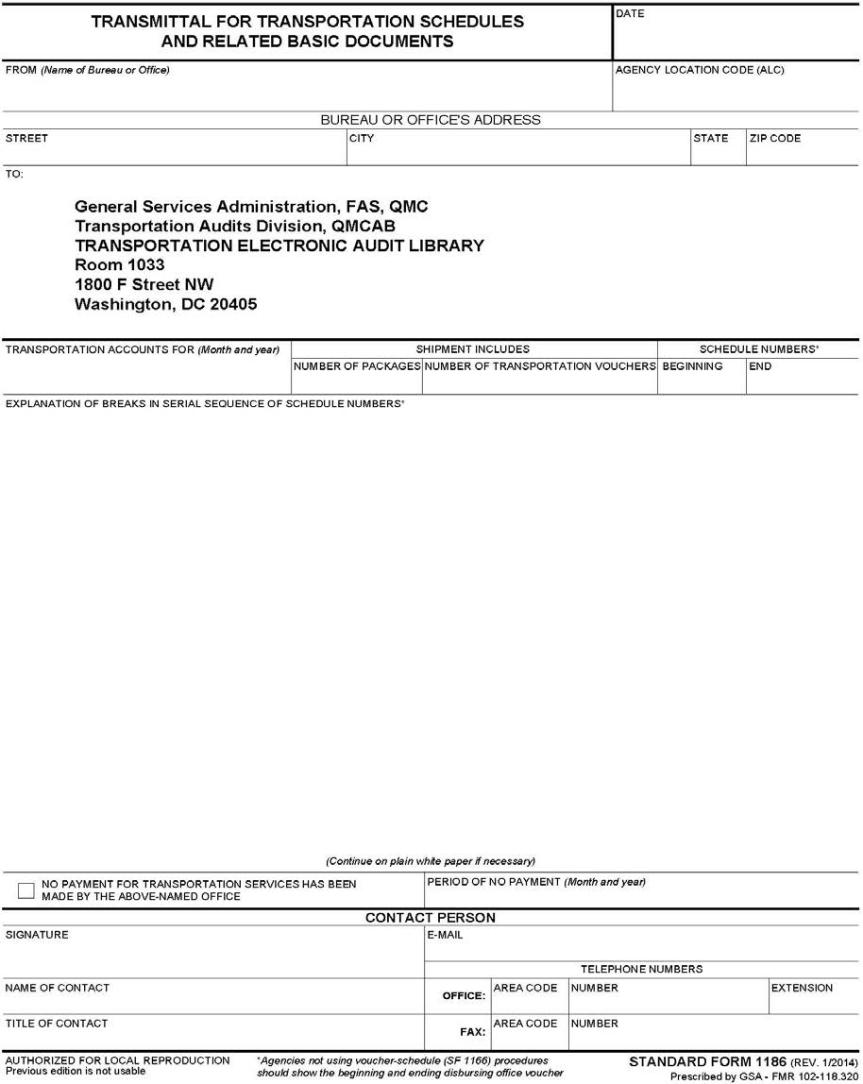

Figure 29. SF 1186, TRANSMITTAL FOR TRANSPORTATION SCHEDULES AND RELATED BASIC DOCUMENTS

U.S. General Services Administration

U.S. General Services Administration