May 2021

Table of contents

Foreword

Introduction

- Transportation requirements

- Agency requirements

- General services administration requirements/agency review assistance program

- Exemptions from prepay audit requirements

Chapter 1: The transportation document

- Types of bills of lading used by the U.S. Government

- Control and accountability

- Prohibitions

- Where to get help

Chapter 2: Bill of lading

- Preparing the bill of lading

- Lost bill of lading

- General instructions and administrative directions

- Instructions to consignee

- TSP receipt of shipment and certification of delivery procedures

Chapter 3: U.S. Government bill of lading – international and domestic overseas shipments

- Completing the U.S. Government bill of lading

Chapter 4: U.S. Government bill of lading – privately owned personal property and electronic bills of lading

- U.S. Government bill of lading – privately owned personal property

Chapter 5: U.S. Government bill of lading – continuation sheet

Chapter 6: Obtaining and creating bill of lading numbers

Chapter 7: Disposing of spoiled, canceled, unused, or obsolete government bills of lading

- Instructions for accountable offices

Chapter 8: Altering or correcting the bill of lading

Chapter 9: Substitute documentation in lieu of lost government bill of lading

- Billing when GBLs are lost or destroyed

- Processing a GBL that was reported lost but has been recovered

Chapter 10: Terms and conditions

Chapter 11: Use of U.S. flag transportation service providers

Chapter 12: Exclusive use of vehicle

Chapter 13: Reconsignment and diversion

Chapter 14: Completing public voucher for transportation charges

- Completing the public voucher for transportation charges

- Instructions for TSPs

- Instructions for agencies

Chapter 15: Agency payment and submission of transportation bills for audit

- Required agency prepayment audit program

- Submitting your agency prepayment audit program to GSA

- Submission of paid transportation bills for postpayment audit

Chapter 16: Damage claims

Appendix A: Glossary of terms

Appendix B: Acronyms

Foreword

We prescribe regulations governing the use of the bill of lading, including the U.S. Government bill of lading and commercial bills of lading, both paper and electronic as referenced in the Code of Federal Regulations at 41 CFR Parts 102-117 and 102-118.

This handbook is developed to assist administrative and fiscal personnel who prepare and process bills of lading and employees directly involved in supply and distribution activities. This handbook is designed to improve efficiency in the shipping and receiving operations for the government, in improved transportation service provider services, and in conservation of transportation funds. Those who are directly involved in managing and arranging freight and household goods shipments should also reference 41 CFR Part 102-117.

Introduction

Transportation requirements

Agencies and transportation service providers must comply with 31 U.S. Code 3726, 41 CFR Part 102-118.

31 U.S.C. 3726 requires each agency that receives a bill from a carrier or freight forwarder for transporting an individual or property for the U.S. Government shall verify its correctness (to include transportation rates, freight classifications, or proper combinations thereof) using prepayment audit in accordance with the requirements of this section and regulations prescribed by the Administrator of GSA.

Applicable authorities

General prepayment audit policies (4.1.2.1) - 31 U.S.C. 3726

Payment for transportation

- Requires that federal agencies conduct prepayment audits of all transportation billings

- Grants authority to us for oversight of agencies’ prepayment audits

- Authorizes us to conduct pre or postpayment audits of transportation bills of any federal agency

General postpayment audit policies (4.2.2.1) - 31 U.S.C. 3726

Payment for transportation

- Authorizes us to conduct pre or postpayment audits of transportation bills of any federal agency

- Requires expenses of transportation audit postpayment contracts and contract administration, along with the expenses of all other transportation audit and audit-related functions performed by us to be financed from overpayments collected from carriers and not to exceed those collections.

- Allows us to provide transportation audit and related technical assistance services, on a reimbursable basis, to any other agency.

Agency requirements

All executive agencies are subject to the information in this handbook. 41 CFR §102-118.20§ 102-118.35

Standard Form 1103, U.S. Government bill of lading is a bill of lading issued by a government agency or entity. It must be issued to transport government property and household goods internationally, including the United States to Alaska, Hawaii, its territories and possessions. Agencies may also choose to use the GBL for domestic transportation. A BOL conveys specific terms and conditions to protect the government’s interest and serves as the contract of carriage. These terms and conditions are available at 41 CFR 102 and may be incorporated by reference.

Prepayment audit requirement

Each agency that receives a bill from a TSP for transporting an individual or property for the U.S. Government shall verify the invoice for correctness prior to payment. A prepayment audit of transportation invoices verifies, at a minimum:

- Transportation rate requirements

- Freight classifications

- Proper combinations thereof

Agencies are required to establish a prepayment audit program and submit their prepayment audit plan to our for approval. § 102-118.290, § 102-118.270, § 102-118.25, § 102-118.325

Postpayment audit requirement

All agencies must forward all paid transportation bills, including supporting documents for a postpayment audit, to:

General Services Administration

Transportation Audits Division (QMCA)

1800 F Street NW, Mail Hub 3400

Washington, DC, 20405 §102-118.425 § 102-118.445

Agencies must forward all (paid) transportation billing documents along with any relevant backup documents to:

GSA, Transportation Electronic Library (QMCAB)

1800 F Street NW, Mail Hub 3400

Washington, DC, 20405 § 102-118.80

Agencies must send copies of each quotation, tender, or contract of special rates, fares, charges or concessions with TSPs including those authorized by 49 U.S.C. 10721, 15504, and 13712 upon execution to us, QMCAB at the above address or by email to SDDCrates@gsa.gov. § 102-118.260

The following information must be annotated on all transportation documents and bills:

- The date the bill was received from a TSP

- A TSP’s invoice number

- Your agency name

- A DRN

- Amount billed

- Date invoice was approved for payment

- Payment date and amount agency paid

- Payment location code number and office name

- Payment voucher number

- Complete contract, tender, or tariff authority, including item or section number

- The TSP’s TIN

- The TSP’s standard carrier alpha code

- The auditor’s full name, email address, contact telephone number, and authorization code

- A copy of any statement of difference sent to the TSP

Information specific to TSPs

- TSPs are subject to the information in this handbook. § 102-118.20 §102-118.35,

- TSPs have a three year time limit to file a transportation claim with Transportation Audits Division. § 102-118.470

- TSPs must follow specific requirements when filling claims and disagreements with GSA. § 102-118.545, § 102-118.665

- The Division has the discretion to make alternative arrangements with the TSP if the TSP is unable to promptly pay their debt. § 102-118.670

GSA requirements

Under the authority of Section 322 of the Transportation Act of 1940, as amended (31 U.S.C. 3726), the Administrator is authorized to prescribe regulations for the audit of transportation bills. Through delegation of this authority, our Transportation Audits Division is responsible for reviewing agency fiscal and transportation practices, policies, programs, and procedures to determine their adequacy and effectiveness as they relate to the audit of freight and passenger transportation payments (41 CFR 102-118.435). Therefore, we are responsible for:

- Monitoring and reviewing agency prepayment audit process

- Performing a postpayment audit on all U.S. Government agency transportation documents

- Educating agencies on proper submission of paid transportation documents

Agency review and assistance meeting

Your agency could be losing money without even being aware of it!

As part of the prepayment audit plan compliance, agencies commit to report on a monthly basis their prepayment transportation audit activity to our Transportation Audits Division. We receive and track all of the agency prepayment audit reports on a monthly basis using a prepayment audit report tracking sheet. This report is used to track each month’s submission, and roll up to an entire fiscal year compliance.

The Division has been delegated the responsibility to monitor agency compliance with P.L. 105- 264 by verifying the effectiveness of an agency’s prepayment audit program through data analysis. To facilitate this responsibility, the Division has developed a standardized Prepayment Audit Plan template agencies complete and submitted for final approval by the Division, in accordance with 41 CFR Part 102-118.

The PPAP template will be periodically reviewed by the Division. Upon review, if necessary, the template will be emailed to the agency/bureau point of contact to verify that the plan is still accurate and up-to-date. The frequency of periodic reviews will be dependent upon an individual agency’s program. For instance,

- If a program uses a third party payment system, direct contract, GSA or a schedule-contracted auditor, the template will be reviewed at the expiration of the contract, inter-agency agreement, or memorandum of agreement.

- However, if an agency performs their own internal prepayment audit, a periodic review will be conducted approximately every two years.

To request an agency review virtual meeting or visit, email Audit.Policy@gsa.gov. In the subject section of your email type, “Agency review request meeting”.

Exemptions from prepayment audit requirements

A prepayment audit must be performed on all modes of transportation (air, water, pipeline, rail, motor) for all types of shipments (freight, household goods, small parcel, employee travel) regardless what method of payment is used, including a charge card.

An agency may request an exemption from prepayment audit requirements. The exemption request must explain in detail why the request is needed. The exemption may be based on such things as cost effectiveness, public interest, adverse effects to the agency’s mission, or feasibility.

The agency exemption request(s) may include but not limited too:

- an agency or subagency

- a specific mode

- establish of a minimum dollar threshold

- a method of payment such as a charge card

Agencies must submit a request for an exemption to audit.policy@gsa.gov, subject line: prepayment audit exemption request

An exemption is for a specific length of time. Agencies can request an extension of the exemption. For information on extending the exemption contact our Transportation Audits Division.

The Division in cooperation with our Office of Government-wide Policy will review the request and provide a response to the agency within 90 days.

Note: For cost reimbursable contractors only, submit transportation bill for prepayment audit only when the freight shipment charges exceed $100.00. Bills under $100.00 shall be retained on-site by the contractor and made available for on-site government audits (Federal Acquisition Regulation 52.247-67)

Chapter 1: The transportation document

A BOL is a document that is the basic transportation contract between the shipper of goods and the TSP detailing the type, quantity, and destination of the goods being transported. Its terms and conditions bind the shipper and carrier. As a contract of carriage, it serves as a receipt of goods and documentary evidence of title. This document must accompany the shipped goods no matter the mode of transportation and is signed by an authorized representative of the carrier, shipper, and receiver.

Common types of BOLs include:

- SF 1103, is a BOL issued by a government agency or entity. A GBL must be issued to transport government property or household goods internationally, as well as shipping from the continental U.S. to Alaska, Hawaii, and U.S. territories; however, at an agency’s discretion, a GBL may be used for domestic transportation. A GBL conveys specific terms and conditions to protect the government’s interests and serves as the contract of carriage.

- A commercial bill of lading is a BOL issued by a commercial carrier.

- An ocean bill of lading is a BOL issued for the transport of cargo via ocean carrier.

- An air waybill is a BOL issued for the transport of cargo via air carrier.

- SF 1203, U.S. Government bill of lading—Privately Owned Personal Property is used by the Department of Defense to transport household goods.

A BOL may also serve as:

- List of property being shipped

- Contract of carriage shipping order

- Documentary evidence of title TSP’s waybill

- Freight bill to the government

- Notice of condition of shipment at final destination

- Authorization of shipment

Control and accountability

When issued a control number by GSA, GBLs are controlled documents and an agency is responsible for the physical control and accountability, including issuance and disposal, of the forms and must implement safeguards to protect them from unauthorized use.

Prohibitions

The issuance of a BOL after performance of freight service is prohibited. The issuance of a duplicate BOL is also prohibited.

Where to get help

Questions concerning preparation and processing of any of the above mentioned bills of lading may be directed to audit.policy@gsa.gov.

Chapter 2: Bill of lading

Description and use

A completed and certified BOL is necessary for a TSP to be paid. When the agency uses or mandates the use of a third-party payment system or other electronic system of payment the carrier is generally not required to present a completed SF 1113, Public Voucher for Transportation Charges. However when a TSP submits manual payments for processing, including when paper invoices received via mail or email are submitted to the agency or their auditor by the TSP, an SF 1113 is required to be completed, certified by the TSP, and submitted to the agency before the payment can be processed. In all cases the BOL will contain all information as required by the agency in order to properly process the payment; this may include information needed by the government shipping and accounting officers, including contract and fiscal authorizations.

Shipments for express courier or small package shipments moving on BOLs need not be billed to the government on SF 1113s.

TSP receipt of shipment and certification of delivery procedures

A TSP or TSP’s agent must sign and date the original BOL, thereby certifying that it has taken possession of the shipment. After delivery, a TSP must certify the delivery by annotating the BOL with the date and place of delivery. At the time of delivery, any loss, damage or shortage must be noted, signed by the consignee, and acknowledged by the signature of the TSP’s agent. If the TSP or its agent fails to provide a signature it does not negate the claim or prevent the claimant from filing a claim against the TSP.

Preparing the BOL

In addition to the information customarily entered on the BOL, the information listed below must also be included. This additional information is necessary to accurately document the transportation service requested and performed for each shipment, and to facilitate the subsequent audit and payment of transportation charges.

See Chapter 3, under the heading “Completing the U.S. Government bill of lading” for detailed instructions on what should be included under each item listed below.

- Standard point locations codes

- Consignee

- Shipper name and address

- Appropriation chargeable

- Route/via

- Bill charges to

- Agency location code

- Description of articles

- Weight

- TSPs pickup date

- Tariff/special rate authority

- Length/cube ordered

- Length/cube furnished

- Annotate a route order number, traffic control number, or other document identification number that has been assigned by the transportation officer or routing authority. Traffic control numbers are used for:

- internal control and identification of specific shipments

- to trace lost or overdue shipments

- to show routing authority

- to help distribute tonnage among competing TSPs.

Accessorial or special services

Requirements for accessorial or special services affecting charges in addition to the line haul must be annotated on the BOL. The annotation must name the TSP upon whom the request was made and the kind and scope of services ordered and must be signed by or for the person ordering the services. If such an annotation is impracticable, a statement containing the information and bearing the number of the covering BOL and signed by or for the person who ordered the service will be acceptable. Such services include, but are not limited to the following:

- Stop off

- Extra delivery

- Capacity load

- Exclusive use of a vehicle

- Reconsignment and delivery

- Redelivery

- Security/protective services

- Detention

The TSP should note on the BOL when accessorial or special services are requested but not furnished.

Lost BOL

When the original BOL has been lost or destroyed, and therefore not available to the billing TSP, the shipper or origin TSP possessing an authentic copy may have it certified by the government office that authorized the shipment. The paying office should establish controls to prevent duplicate payment.

If the original BOL is recovered, the original should be forwarded to the paying office. If settlement has already been completed, the recovered original CBL should be canceled; properly annotated with the disbursing office symbol number, the disbursing office voucher number (our Certificate of Settlement number), and payment date; and transmitted to:

General Services Administration

Transportation Audits Division (QMCA)

1800 F St NW, MS 3400

Washington, DC 20405

General Instructions and Administrative Directions

Computer generated preparation

Departures from the exact specifications of the standard BOL forms are not permitted. Agencies using electronic payment systems for preparation of BOLs may produce computer generated forms, but such forms must conform to all specifications of the BOL when printed, including overall size, wording, arrangement, color, construction, and grade of paper. Minor adjustments in spacing to accommodate differences in alignment of printing are permissible, but the original and all copies of the GBL must register from part to part.

Copying and printing on blank standard forms

When it is economical and advantageous to do so, agencies may print any or all of the following information on the GBL:

- Name of shipper (agency/department, and bureau or service)

- Bill to or paying office

- Name and title of issuing officer, issuing office, and place of Issue appropriation or fund chargeable

- Origin

After the above information is printed on to the GBL agencies may copy and use the blank forms for agency usage only. The above information should only be printed on blank unused GBLs. Duplicating GBLs after a shipment has been completed is prohibited.

Instructions to consignee

Strict adherence to the following instructions is imperative as the consignee’s signature on the TSP’s delivery documents constitutes the final receipt of the shipment in its delivered condition.

In case of discrepancies, the consignee must make certain the TSP’s representative signs any loss or damage notations on the TSP’s delivery documents. Shortage, loss, or damage reports should not be made on the GBL but on shipment discrepancy forms. The GBL does not constitute a damage claim report but is evidence of the shipment. Regulations of a particular agency, department or bureau concerned with the shipment should be consulted for specific reporting requirements involving discrepant shipments. Agencies are responsible for filing claims and collecting moneys owed for damaged, shortages, or lost shipments.

TSP receipt of shipment and certification of delivery procedures

At the time the shipment is tendered the original GBL and three copies must be given to the origin line-haul TSP or their agent. The origin and participating TSPs should transmit the original GBL to the last line-haul TSP authorized to bill for the transportation charges. The billing TSP will be responsible for properly completing, from the delivery documents, the “CERTIFICATE OF BILLING”.

If a shipment is not made as a through BOL, then the pick-up carrier must be issued all BOLs. Each BOL must address the corresponding contract, tariff, or tender number. Failure to address declared value on each BOL may result in the TSP’s released value being applied to the entire shipment.

Whenever the GBL is used by a contractor as shipper, one memorandum copy, certified by the TSP, will be retained by the contractor. Certified memorandum copies must be promptly forwarded by the contractor to the issuing office.

The TSP must annotate on the GBL when an accessorial or special service was requested but not furnished. The TSP must also endorse the GBL to certify any special services provided but not accounted for in the original transportation request.

Chapter 3: U.S. Government bill of lading – international and domestic overseas shipments

SF 1103, U.S. Government bill of lading – international and domestic overseas shipments must be used for international shipments, including domestic offshore shipments. This form can be downloaded from the Forms Library. You can also find instructions to help complete SF 1103.

Chapter 4: U.S. Government bill of lading – privately owned personal property and electronic bills of lading

U.S. Government bill of lading – privately owned personal property

SF 1203, U.S. Government bill of lading – privately owned personal property is used to fill the special needs of DOD’s household goods unaccompanied baggage and mobile homes movements. It is used for DOD shipment of personal property. SF 1203 is issued by the U.S. Army Publications and Printing Command and should be requisitioned.

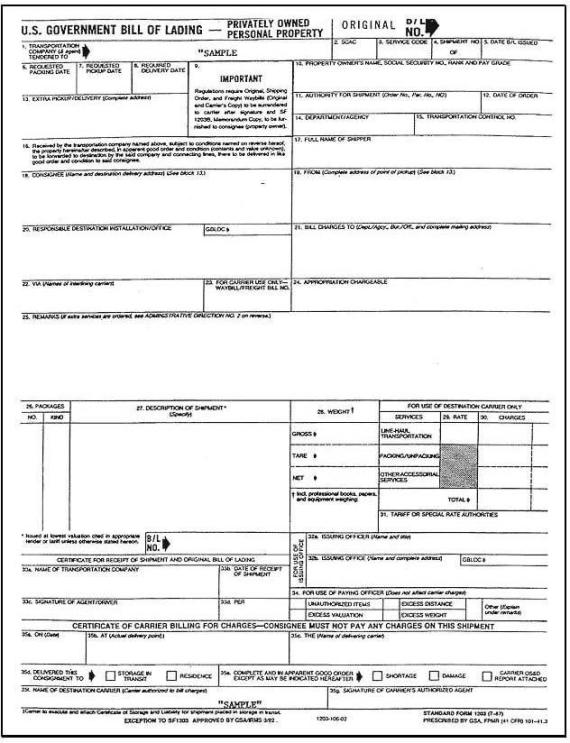

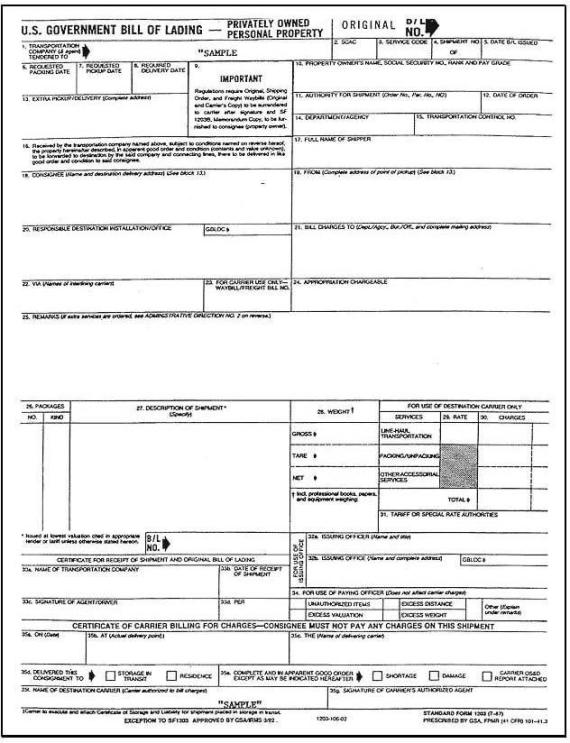

Figure 2 - SF 1203, U.S. Government Bill of Lading - Privately Owned Personal Property

Although we are responsible for prescribing procedures governing the use of SF 1203, DOD users should refer to the DTR, Part IV, Chapter 413 for additional information and instructions on completing SF 1203.

Chapter 5 U.S. Government bill of lading – continuation sheet

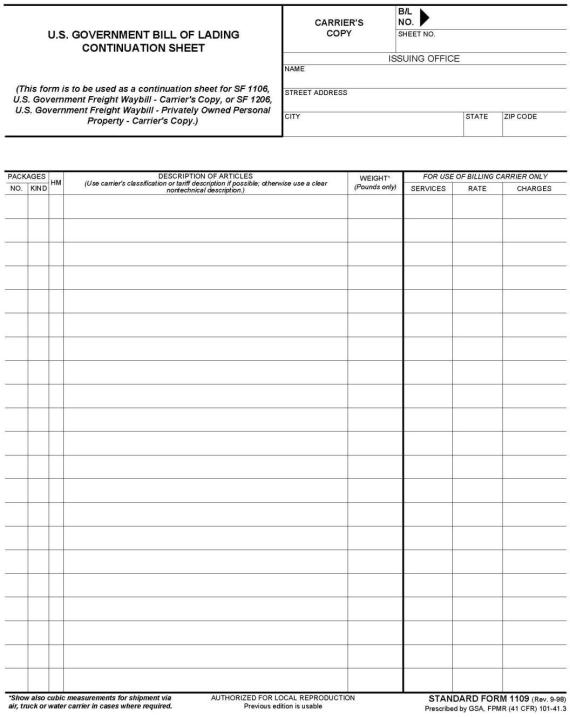

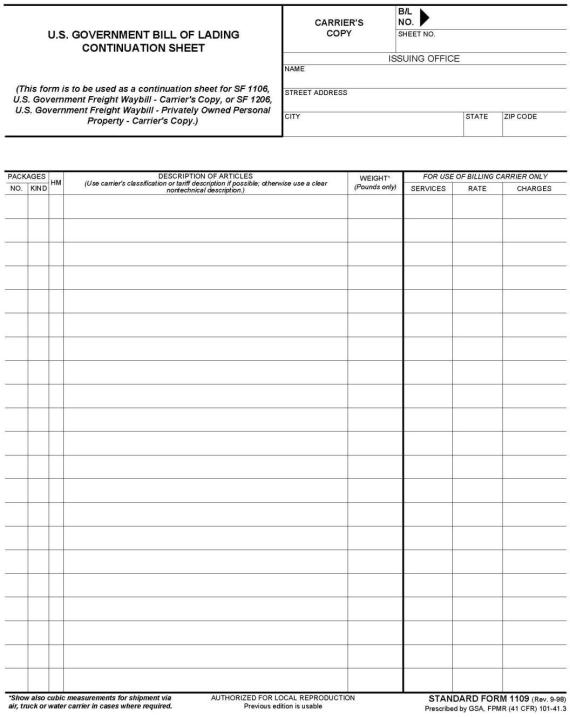

Standard Form 1109, U.S. Government Bill of Lading - Continuation Sheet should be used and attached to the GBL when additional space in any of the spaces on the GBL is needed. The additional information should be cross-referenced to the appropriate space on the GBL.

Figure 3 – SF 1109, U.S. Government Bill of Lading – Continuation Sheet

Chapter 6: Obtaining and creating BOL numbers

Agencies allowing the use of a commercial TSP’s BOL must create a unique numbering system to track and monitor each BOL to prevent a TSP from billing an agency more than once per shipment. Agencies using GBL’s must also create a numbering and tracking system that assures a unique number is assigned to each GBL. Alternatively, agencies can request a control number or block of control numbers from us. When we issue control numbers the documents to which the number is assigned becomes a controlled document and must be treated as such. The GBL form, SF1103, is available in the Forms Library.

An agency can receive an assigned block of GBL control numbers via email at forms@gsa.gov or by mail at:

General Services Administration Federal Acquisition Service (FAS)

Southwest Supply and Acquisition Center

Technical Services and Commodity Branch (7QSBBB) 819 Taylor Street, Room 6A00

Fort Worth, TX 76102

SF 1103 number sets begin with letter and number A- 0,000,001 and continue through A-9,999,999, after which the letter symbol changes to B, then to C, etc.

SF 1203, U.S. Government bill of lading – Privately Owned Personal Property sets are distinguished from regular GBLs by the inclusion of the letter “P” prior to the form’s serial number. PPGBLs start with letter and number AP-000,001 and continue through AP-999,999, after which the lettered symbol becomes BP, CP, etc.

Fort Worth, TX 76102

Jill Burt at jill.burt@gsa.gov or by telephone at 817-850-8247.

With your request, include the following:

- Agency/office name

- Complete mailing address

- Point of contact

- Telephone number

- Email

- How many GBL numbers are being requested

Chapter 7: Disposing of spoiled, canceled, unused, or obsolete GBLs

Obsolete, canceled, lost, unused, or GBLs spoiled in preparation should be returned to the agency’s office that retains accountability.

Instructions for Accountable Offices

- Each accountable office should maintain a record of all GBL numbers that are issued to their agency.

- The accountable office should make a list of all GBL numbers that are spoiled, canceled, lost, or that will never be used by the agency. Included on the list should be the date and whether the GBL numbers are for SF 1103, The completed list(s) should be forwarded to:

GSA, Inventory Management, Forms Program (QSDLBAB-WS)

819 Taylor Street, Room 6A00

Fort Worth, TX 76102

or email the list(s) to jeff.fossmeyer@gsa.gov. Wait for confirmation from Fossmeyer or his colleagues before proceeding to number 6 below. - All spoiled, canceled, or unused SF 1203, with or without imprinted GBL numbers, must be returned to the Department of Defense (DOD’s) office of accountability. The accountable office must then follow step 1 above and refer to Part 4, DTR 413, Paragraph C for additional instructions.

- If the DoD accountable office intends on reusing GBL number(s) that were imprinted on unused SF 1203s; they may do so. Those GBL number(s) should not be included on the list of spoiled, canceled, and unused GBL numbers that are returned to us. However, if they are not going to be applied to new SF 1203s, they must be included on the list of GBL numbers that are sent to us as instructed in (1) above.

- Spoiled, canceled, or unused SF 1103 and SF 1203 that do not have GBL numbers imprinted on the form may be disposed of as instructed below.

Agencies must maintain transportation records in accordance with General Records Schedule (1.1 and 5.5). The GRS is maintained by the National Archives and Records Administration.

Unused GBL numbers that were originally intended to be used on SF 1103s, issued before 2003 can be kept by the agency and applied to the revised 2003, SF 1103. There is no need to include these numbers on the list of unused numbers that are returned to us. The outdated SF 1103s may be disposed of as instructed above.

Chapter 8: Altering or correcting the bill of lading

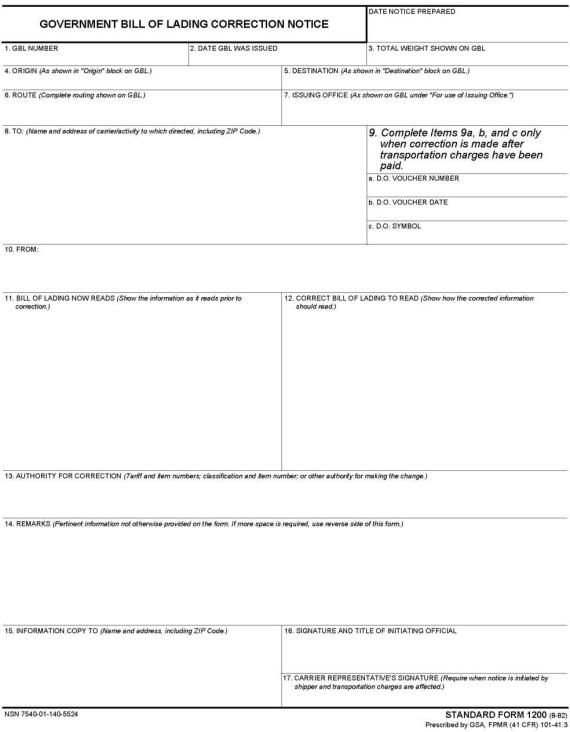

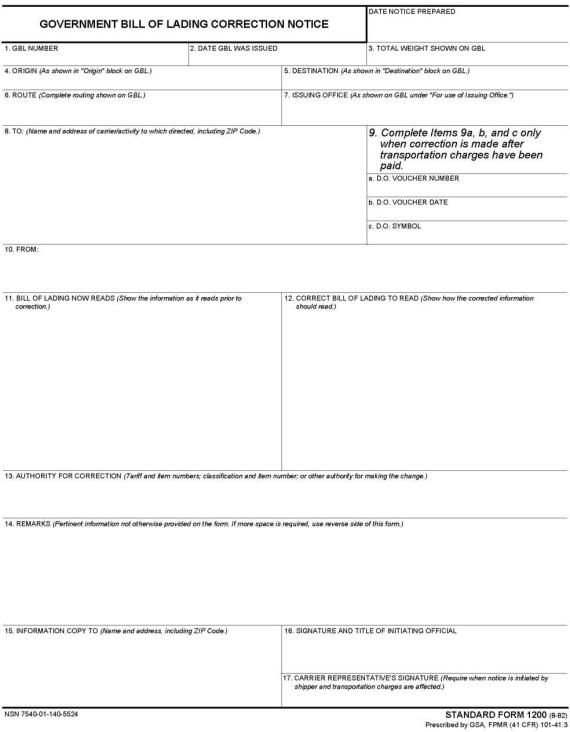

Standard Form 1200, government bill of lading correction notice is used to alter or correct the SF 1103, U.S. Government Bill of Lading – International and Domestic Overseas Shipments and SF 1203, U.S. Government Bill of Lading – Privately Owned Personal Property. It is a single sheet form, and the number of copies to be prepared and distributed is a matter for each federal agency to establish.

Recipients of a correction notice will alter or correct the GBL as indicated on the notice and attach the form to the GBL. Preparation of SF 1200 is not required when alterations or corrections are made prior to the distribution of the GBL. The form is not subject to the provisions of the Paperwork Reduction Act of 1980 (94 Stat. 2812, 44 U.S.C. Chapter 35).

Figure 4 - SF 1200, Government Bill of Lading Correction Notice

Chapter 9: Substitute documentation in lieu of lost government bill of lading

At the time the shipment is tendered, the initial TSP will be given a completed original SF 1103, U.S. Government bill of lading International and Domestic Overseas Shipments and three copies.

In the case of SF 1203, government bill of lading – Privately Owned Personal Property the TSP will receive the completed original, the Shipping Order (SF 1204), the Freight Waybill-Original (SF 1205), and the Freight Waybill-TSP’s copy. The TSP(s) involved in the routing is responsible for custody of these documents during the entire shipping cycle.

Billing when GBLs are lost or destroyed

The original SF 1103 is the primary shipping document that the TSP uses to bill the Government for transportation services rendered. However, if after delivery, the original cannot be located by the billing TSP and it is evident that it has been lost or destroyed; the TSP must use one of the other issued copies of the original SF 1103 when requesting payment. When SF 1203 is issued the Freight Waybill-Original (SF 1205) may be submitted for payment.

The TSP who is authorized to bill for charges must enter on the reverse side a properly executed certificate of delivery, showing all information required in the “CERTIFICATE OF BILLING FOR CHARGES” space on the face of the GBL.

If all copies of the SF 1103 have been lost; the TSP should request and be furnished with a certified true copy of the issuing office’s copy of the GBL, SF 1103. In this case, the issuing office will use the following certification:

“I certify this is a true copy of the SF 1103 in my possession and the services hereto were requested.”

(Signature of issuing office) (Date)

If the Freight Waybill-Original (SF1205) is also lost, the TSP should request and be furnished a certified true copy of the issuing office’s Memorandum Copy (SF 1203-A) of the SF 1203. In this case, the issuing office will use the following certification.

“I certify this is a true copy of the Memorandum Copy (SF 1203-A) in my possession and the services hereon were requested.”

(Signature of Issuing office) (Date)

The issuing office shall make its certification regarding the services requested on the reverse of that copy and forward it to the TSP for certification of delivery and billing in the same manner as that for the Freight Waybill-Original substitution.

The issuing office must maintain a record of all certifications that have been placed on certified true copies of memorandum copies in a BOL accountability record. Also, the issuing office must promptly notify the government paying office to prevent duplicate payment to the TSP.

Processing a GBL that was reported lost but has been recovered

If the lost original GBL is located by either the TSP or the government before settlement is made on the original GBL or Freight Waybill-Original, the original GBL should be used for payment and the certified true copy of the GBL or Freight Waybill-Original should be marked with the notation: “Canceled - original bill of lading located”.

The canceled GBL/Freight Waybill-Original should then be returned to the issuing office for correction of its GBL accounting records and for notification to the payment office-concerned that payment shall be made on the original GBL.

If the lost original GBL is located after settlement is made, the original GBL should be forwarded to the government paying office indicated on the front of the GBL where it should be marked “canceled,” properly annotated with the disbursing office voucher number, (or our certificate of settlement number), and payment date of the Freight Waybill-Original settlement voucher, and forwarded to:

General Services Administration

Transportation Audits Division (QMCA)

1800 F Street NW, Mail Hub 3400

Washington, DC, 20405

If a certified copy (SF 1103 or) was substituted for a lost GBL/Freight Waybill-Original, and the GBL or Freight Waybill-Original is recovered, the above procedure, modified as necessary, should be followed.

Chapter 10: Terms and conditions

The contractual terms and conditions between the TSP and the government are incorporated on the BOL with the following statement, “U.S. Government shipment is subject to the terms and conditions of 41 CFR Parts 102-117 and 102-118.”

Prepayment - In no case shall prepayment of charges be demanded by the TSP nor collection be made from the consignee. The BOL properly certified and attached to an SF 1113, Public Voucher for Transportation Charges, shall be presented to the paying office for payment to the TSP in privity with the contract of carriage as evidenced by the BOL.

Alternation of Rates - The shipment must be made at the restricted or limited valuation specified in the tender, tariff or classification or equivalent contract, arrangement, or exemption from regulation at or under which the lowest rate is available, unless otherwise indicated on the BOL.

Interest on Payments - Interest shall accrue from the voucher payment date on the overcharges made and shall be paid at the same rate in effect on that date as published by the Secretary of the Treasury pursuant to the Debt Collection Act of 1982, 31 U.S.C. 3717.

Chapter 11: Use of U.S. flag transportation service providers

Cargo preference laws

The Cargo Preference Act mandates the use of privately owned, U.S.-flag commercial vessels; to the extent, such vessels are available at fair and reasonable rates, to transport Government personnel, Government-impelled cargoes, and household goods in accordance with cargo preference laws as provided in 46 CFR Chapter 553.

International ocean shipments

Each bill submitted by a freight or household goods forwarder for payment of transportation charges for the overseas movement of personal property (including household goods, personal effects, and, for civilian agencies, privately owned vehicles) shall be supported by a copy of the ocean TSP freight bill along with the GBL. Also each bill submitted by an ocean or freight forwarder for the payment of charges for the transportation of personal effects of officers and employees of the United States, furnished in whole or in part by a foreign-flag TSP, shall be supported by the authorizing official’s certification of the necessity for the use of the foreign- flag TSP. (See 4 CFR 52.2).

For all freight and household goods shipments subject to the cargo preference laws, a copy of the ocean carrier’s master BOL, documenting all freight charges, must be sent to the Maritime Administration within 20 working days of the date of loading for shipments originating in the United States, the District of Columbia, its territories or possessions within 30 working days for shipments originating outside the United States, the District of Columbia, its territories or possessions.

- Additional reporting requirements are prescribed in 46 CFR 381.3.

- Documents are submitted electronically to Cargo.MARAD@dot.gov (preferred method) or mailed to:

Office of Cargo and Commercial Sealift,

Maritime Administration (MAR-620),

U.S. Department of Transportation,

1200 New Jersey Avenue, SE

Washington, DC 20590

International air shipments

The Fly America Act requires cargoes to be transported via a U.S.-flag air carrier for all air cargo transportation funded by the U.S. Government including cargo shipped by contractors, grantees, and others at government expense unless an exception is permissible. (41 CFR 102-117.200 proposed rule)

Each bill for the payment of international air freight transportation charges not involving the use of foreign flag TSPs shall be supported:

- For air TSPs, with a TSP certification that only U.S.-flag service was used or, in absence of such certification, with a copy of the air waybill or manifest showing the underlying s utilized

- For air freight forwarders, with a copy of the air waybill or manifest

Each bill submitted by an air TSP or air freight forwarder for payment of international air freight transportation charges involving, in whole or in part, the use of foreign-flag TSPs shall be supported by:

- A copy of the waybill or manifest showing the underlying TSPs utilized, and a certification, adequately explaining the non-availability of U.S.-flag service, signed by the responsible official of the authorizing agency or the TSP having knowledge of the facts concerning such usage.

Chapter 12: Exclusive use of vehicle

When shipments are made by motor transport, the TSP has access to their equipment during transit, except when seals are applied and the shipper requests exclusive use of TSP equipment. When the shipper requests exclusive use for purposes of cargo security or for other reasons, all copies of the BOL should be annotated with the following:

“Exclusive use of vehicle requested by the government”

______(Signature of individual ordering service)______ ______(Date)______

Also, the seal numbers should be recorded on the BOL. In addition, the shipper must place the following notation on the BOL to be completed, signed, and dated by the delivering TSP:

I certify that exclusive use of vehicle was ordered and furnished from _______

to ____(destination)_____ by ____(TSPs in routing)______ _____(TSPs agent)______ _____(date)_____.

This certification is acceptable support for the payment of higher transportation charges, if any. Similarly, if the TSP does not provide such service, the consignee’s copy of the BOL and the delivering TSP’s documents will be so annotated. All notations must be signed by the consignee and the TSP’s agent.

Warning: “exclusive use of vehicle” does not guarantee expedited service. TSP’s charge premium rates for exclusive use of vehicles, and this service should only be used when essential to the needs of the government.

Chapter 13: Reconsignment and diversion

Reconsignment and diversion are TSP terms used interchangeably to denote the following changes concerning a shipment after it has been tendered to the origin TSP and before it has been released from the custody of the delivering TSP:

- A change in the name of the consignor (shipper).

- A change in the name of the consignee (receiver).

- A change in the destination.

- A change in the route when requested by the consignor, consignee, or owner of the shipment.

- Other instructions to the TSP that require additional movement of the conveyance.

A shipment may be reconsigned or diverted if permitted in the TSP’s tariff or tender:

- While the shipment is in transit.

- After the shipment has arrived at the destination but is still in the possession of the TSP.

Initial instructions directing the reconsignment or diversion may be provided to the representative of the TSP by telephone, email and/or written confirmation and proper documentation. The original and one copy of such written reconsignment or diversion notice properly signed by the person ordering the service and bearing a cross-reference to the BOL, shall be surrendered to the TSP from which the services were ordered. That TSP will transmit the original of the notice to the last line-haul TSP where it will be combined with the original BOL for presentation in connection with the bill for line-haul transportation charges.

Chapter 14: TSP billing procedures and instructions for completing public voucher for transportation charges

TSPs should use Public Voucher for Transportation Charges, SF 1113 and Memorandum Copy, SF 1113-A for billing charges for freight, express, or passenger transportation furnished to the U.S. Government in accordance with official shipping requests. The SF1113 and one SF 1113-A must be submitted to the billing office specified on the GBL. TSPs may download and copy these forms from the Form Library or print these forms commercially. When printing these forms commercially, TSPs shall ensure that the forms conform to the exact size, wording, and arrangement of the approved standard forms and, while no minimum grade of paper is set, TSPs shall provide a reasonable grade of paper stock.

Small shipments moving on commercial forms (generally not exceeding $100.00 in transportation charges) will not be invoiced to the government on SF 1113. These shipments will be billed to the government using the normal commercial invoicing documents.

TSPs should include as many sub vouchers (BOLs) as possible, not to exceed 25, with each voucher, SF 1113, covering charges to be billed to the same office, except for shipments accorded transit privileges and household goods shipments (other than domestic-crated household goods), which should be billed one per voucher. The serial number and amount of each BOL must be shown on the SF 1113 but not descriptive details of the services rendered.

The TSP shall complete the “PAYEE’S CERTIFICATE” section of the voucher. TSPs may use a machine-typed name of the TSP’s certifying official, provided the machine-typed official’s name is initialed by a duly authorized person; or TSP may use a facsimile signature of the TSP’s certifying official, as authorized by that official. The TSP shall complete the tear-off portion of the SF 1113 and shall not substitute a memorandum copy (SF 1113-A) for the tear-off portion.

- The TSP shall not be required to furnish more than one memorandum copy to the agency billed unless otherwise specifically authorized in advance.

- BOLs must not be combined on the same SF 1113.

- Payment of transportation charges must be made to the TSP in privity with the contract of carriage as evidenced by transportation documents.

- When mutually agreeable to the agency and the Transportation Audits Division, the agency is encouraged to use electronic billing for transportation services.

You can also find instructions to help complete SF 1113.

Supplemental billings

Supplemental billings should be invoiced on SF 1113, Public Voucher for Transportation Charges.

The supplemental bill (claim) shall bear the same number as appears in the CARRIER’S BILL NUMBER space of the original bill (SF 1113) but with an alphabetical suffix. An alphabetical sequence of suffixes shall be used for any additional supplemental bills. Each supplemental bill (claim) for freight or household goods transportation services shall be accompanied by a copy of the BOL ordering the service and a copy of the original voucher (SF 1113) submitted by the origin TSP. Generally only one supplemental bill shall be presented for all supplemental charges relating to the items paid on the original bill.

Additional information may be required to explain the supplemental charges such as:

- The tariff or quotation authority for the charges.

- A statement of services ordered and furnished, signed by or for the person who ordered the accessorial services.

- A statement signed by the property owner or authorized agent, certifying receipt of the property at his residence and listing any loss or damage.

Chapter 15: Agency payment and submission of transportation bills for audit

Transportation bills are subject to the provisions of the Prompt Payment Act (31 U.S.C. §3901- 3906 (Office of Management and Budget Circular A-125, (Revised), December 12, 1989)).

Required agency prepayment audit program

All agencies must establish a prepayment audit program. That is, before an agency pays a TSP for transportation services, the agency should verify the correctness of the bill received from a TSP for transporting an individual and property for an agency. See also Public Law 105-264, Section [PDF, 224KB] and Title 31 United States Code 3726.

Agencies may use one of the following means to perform a prepayment audit:

- Create an internal prepayment audit program.

- Contract directly with a prepayment audit service provider.

- Secure a prepayment audit contractor from our Multiple Awards Schedule by visiting https://www.gsaadvantage.gov and selecting Financial Services.

- Use a third-party payment system or charge card company that includes prepayment audit functions.

The prepayment audit cannot be conducted by the same firm providing the transportation services for the agency. If a move manager is being utilized, the move manager may not have any affiliation with or financial interest in the transportation company providing the transportation services for which the prepayment audit is being conducted

Submitting your agency prepayment audit program to us

Once an agency has decided its method of prepayment audit they must submit the prepayment audit plan by email to QMCATariffs@gsa.gov with the words “Agency prepayment audit plan” on the subject line. The prepayment plan must include:

- The submitting agency’s Agency Location Code (this code is assigned to each agency by the Department of the Treasury).

- Which one of the above prepayment methods the agency is using.

- Name and contact information (including email address) of prepayment auditor.

- Copy of the prepayment audit contract or memorandum of understanding between the selected prepayment auditor and the agency.

Your agency prepayment audit(or) should:

- Requires the agency’s CFO approval of the transportation prepayment audit program with submission to the Transportation Audits Division.

- Comply with the Prompt Payment Act.

- Assure that each TSP bill or employee travel voucher contains appropriate information for the prepayment audit to determine which contract or rate tender is used and that the type and quantity of any additional services are clearly delineated.

- Verify all transportation bills against filed rates and charges before payment.

- Forward all transportation documentation monthly to the Division.

- Establish procedures in which transportation bills not subject to prepayment audit (i.e., bills for unused tickets and charge card billings) are handled separately and forwarded to the Division.

- Allow for your agency to establish minimum dollar thresholds for transportation bills subject to audit.

- Maintain a statement in cost reimbursable contracts contract or rate tenders that the contractor shall submit to the address and in the electronic format identified for the prepayment audit, transportation documents which show that the government will assume freight charges that were paid by the contractor. Bills under $100 shall be maintained by the contractor and made available for the on-site government audits.

- Require your agency’s paying office to offset, if directed by the Division, debts from amounts owed to the TSP within the three years.

- Implement a process to ensure complete and accurate audits of all transportation bills and notifications to the TSP of any adjustment within seven calendar days of receipt of the bill.

- Implement an appeals process as part of the approved prepayment audit program for TSP to appeal any reduction in the amount billed.

- Create accurate notices to the TSP’s that describe and detail the reasons for any full or partial rejection of the stated charged on the invoice.

- Implement a unique agency numbering system to handle commercial paper and practices.

Submission of paid transportation bills for postpayment audit

We maintain a list of agencies that submit bills for postpayment audits and will be notified immediately of any changes to payment location.

Your agency submission of transportation documents must contain the following information:

- agency location code

- amount paid

- date paid

- document reference number

- voucher number

- location

Submissions should be made in the following manner:

Mail submissions on Compact Disks or assembled paper documents to;

General Services Administration

Transportation Electronic Audit

Library(TEAL)1800 F Street NW,

Mail Hub, 3400 Washington DC,

20405

- Email electronic submissions in .pdf format to: QMCATariffs@gsa.gov with the words “Postpayment Audit BOL” on the subject line.

- Submit paid bills to us at the end of each account month; avoid multiple account month submissions.

If, due to an administrative oversight, this is not done, and it becomes necessary to submit multiple account months at the same time;

- the most recent account month should be forwarded in a separate package,

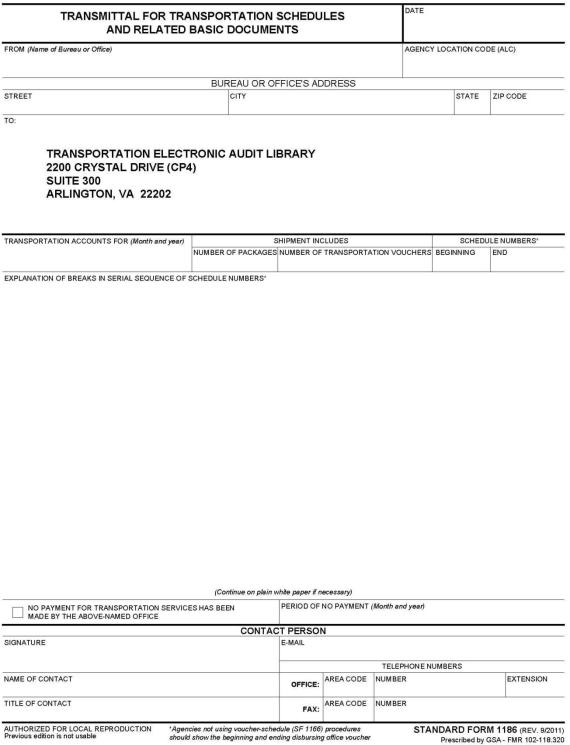

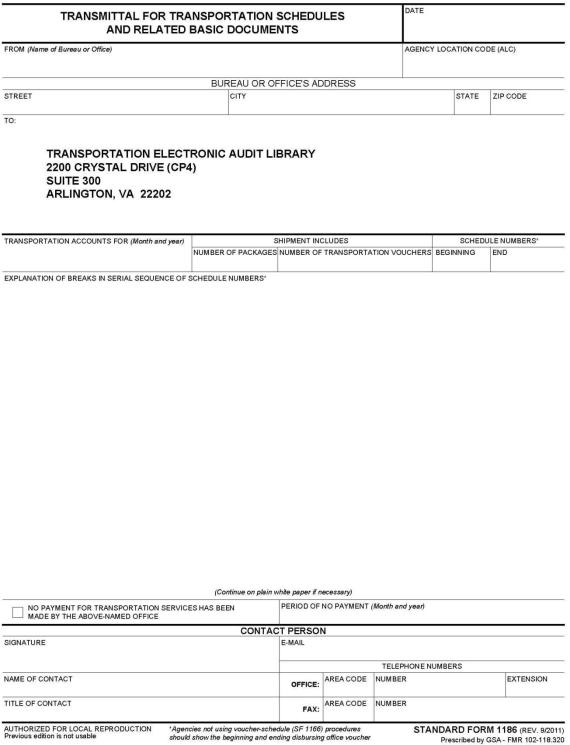

- all prior account months should be bundled by month, each with an accompanying Transmittal for Transportation Schedules and Related Basic Documents, Standard Form (SF) 1186 and should be forwarded in one package clearly marked as to its contents.

- Ensure that each SF 1113, contains the paid date.

- Identify withheld vouchers – If one or more vouchers are found for a month already submitted, please prepare a separate SF 1186 with a statement that the vouchers listed were inadvertently left out of submission for (month and year) which was forwarded to GSA on (year/month/day).

- Identify delayed vouchers/doubtful claims - Any transportation vouchers that have not been paid because they are doubtful claims must be identified on a separate SF 1186 and forwarded to:

General Services Administration

Transportation Audits Division (QMCA)

1800 F Street NW, Washington DC 20405 - Submit negative reports - If no SF1113’s are paid during the month, check the space, and add “no payment for transportation services has been made by the Above-named office” in the lower left corner of the SF 1186 and submit it to the Division.

Figure 7 - SF 1186, Transmittal for Transportation Schedules and Related Basic Documents

Chapter 16: Damage claims

The Transportation Audits Division does not process transportation damage claims.

A claim for damages is a lawful demand by a shipper or consignee to a TSP for reimbursement due to the loss, shortage, or damage of a shipment. The claimant must provide the TSP with the facts relating to the damage claim. The claim must:

- Contain facts sufficient to identify the shipment

- Assert liability for alleged loss, damage, injury, or delay

- Demand payment of a specified or defined amount of money. 49 CFR 370.3(b)

The claimant may also include the prorated shipping costs as part of the amount of the claim.

At the time of delivery, if there is any loss, shortage or damage, it should be noted on all copies of the BOL and any accompanying TSP issued delivery documents. The consignee and the TSP’s agent must acknowledge through signature the loss, shortage, or damage to the property. There is no specific form that must be filed, however TSPs may have a form for the claimant to use. We provide Optional Form 362 for agencies to track the progress of transportation claims.

Concealed damage

When a loss or damage is not discovered until after delivery and receipt of the shipment, the consignee should promptly file a damage claim with the TSP. Because the damage was concealed and not acknowledged by the delivering TSP does not preclude the claimant from filing a damage claim. However, it may require the claimant to prove that the damage did not occur before tender to the carrier or after delivery to the receiving facility. The longer a claimant waits to report concealed damage, the more difficult it may be to prove the cargo was not damaged after delivery.

Filing deadlines

Time limits for filing claims or a corresponding lawsuit vary by mode and may be impacted by the tariff, TOS, contract or negotiated rate. Agencies should file damage claims as soon as the damage is discovered in order to meet filing deadlines.

Individual agencies must establish policies on processing and managing freight damage claims.

For additional information regarding property damage claims see the Transportation Damage Claims and Indemnification Handbook at https://www.gsa/gov/policy.

Appendix A: glossary of terms

Agency – Any department or establishment of the federal government defined by 5 U.S.C. 305, whose payment for transportation services are subject to the transportation audit provisions of section 322 of the Transportation Act of 1940, as amended (31 U.S.C. 3726). Also included are Federal entities such as mixed ownership and wholly owned corporations, if they request coverage by these regulations and such coverage is permitted by GSA.

Bill of lading (BOL) – When used in this handbook it refers to commercial bills of lading and government bills of lading.

Commercial bill of lading (CBL) – The commercial transportation document used as a receipt of goods, evidence of title, and generally a contract of carriage.

Defense Transportation Regulation (DTR) DOD Regulation 4500.9-R – This regulation establishes policy and procedures governing the movement of passengers, cargo, and personal property to, from and between the continental U.S. and outside the continental U.S..

Government bill of lading (GBL) – When used in this handbook GBL refers to SF 1103, U.S. Government bill of lading – International and Domestic Overseas Shipment and SF 1203, U.S. Government bill of lading – Privately Owned Personal Property.

Postpayment audit – Examination of agency transportation billing documents after payment to determine their validity, propriety, and conformity with tariffs, quotation, agreements or tenders with subsequent adjustments and actions to protect the interest of the agency .

Prepayment audit – Examination of agency transportation billing documents before payment to determine their validity, propriety, and conformity with tariffs, quotation, agreements or tenders with subsequent adjustments and actions to protect the interest of the agency.

Privately Owned Personal Property Government Bill of Lading (PPGBL) – SF 1203, the agency transportation document used as a receipt of goods, evidence of title, and generally a contract of carriage. It is only available for the transportation of household goods, and use is mandatory for the Department of Defense, but optional for other agencies.

Rate authority – Charges for transportation services allowed under rates, fares, and charges published in tariffs, tenders and other equivalent arrangements including section 13712 of the Revised Interstate Commerce Act, as amended (49 U.S.C. 13712).

Supplemental bill – A bill submitted to an agency by the TSP for services that require additional payment after reimbursement for the original bill. The need to submit a supplemental bill may occur due to an incorrect first bill or due to charges which were not included on the original bill.

Taxpayer identification number (TIN) – The number required by the Internal Revenue Service to be used by the TSP in reporting income tax or other returns. For a TSP, the TIN is an employer identification number.

Transportation service provider (TSP) – Formerly called carriers, TSPs perform the physical movement of products, people, household goods, and any other objects from one location to another for an agency.

Appendix B: Acronyms

| Acronym | Title |

|---|

| ALC | Agency Location Code |

| BOL | Bill of lading |

| CBL | Commercial bill of lading |

| CFR | Code of Federal Regulations |

| CLS | Carload shipment |

| DO | Disbursing office |

| DoD | Department of Defense |

| DPM | Direct procurement method |

| DTR | Defense transportation regulations |

| FAS | Federal Acquisition Service |

| GBL | Government bill of lading |

| GBLOC | Government bill of lading Office Code |

| GSA | General Services Administration |

| HHG | Household goods |

| HM | Hazardous material |

| IAA | Inter-agency agreement |

| MOA | Memorandum of agreement |

| NMFTA | National Motor Freight Traffic Association, Inc. |

| OGP | Office of Government-wide Policy |

| PBP&E | Professional books, papers, and equipment |

| PHMAS | Pipeline and Hazardous Material Safety Administration |

| PL | Public law |

| POC | Point of contact |

| PPAP | Prepayment audit plan |

| PPGBL | Privately Owned Personal Property GBL |

| PSC | Protective Service Code |

| QM | Travel, motor, vehicle, and card services |

| QMC | Office of Travel and Transportation |

| QMCA | Transportation Audits Division |

| QMCAA | Accounts and Collections Branch |

| QMCAAA | Accounts Section |

| QMCAAB | Collections Section |

| QMCAB | Audit Policy and Review Branch |

| QMCAC | Disputes Resolutions Branch |

| QMCB | Business Management Division |

| ROD | Report of Discrepancy |

| SCAC | Standard Carrier Alpha Code |

| SDDC | Surface Deployment and Distribution Command |

| SF | Standard form |

| SPLC | Standard Point Locations Code |

| TARPS | Transportation Accounts Receivable Payable System |

| TEAL | Transportation Electronic Audit Library |

| TFMS | Transportation Financial Management System |

| TIN | Taxpayer identification number |

| TLS | Trailer load shipment |

| TMC | Traffic management center |

| TMSS | Transportation Management Services Solution |

| TPI | TransPort Integrator |

| TPPS | Third party payment system |

| TPUS | Transportation and Public Utilities Services |

| TSP | Transportation service provider |

| USC | United States code |

U.S. General Services Administration

U.S. General Services Administration