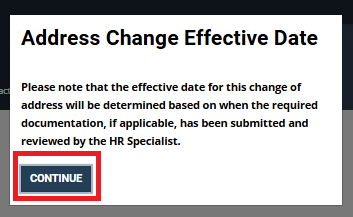

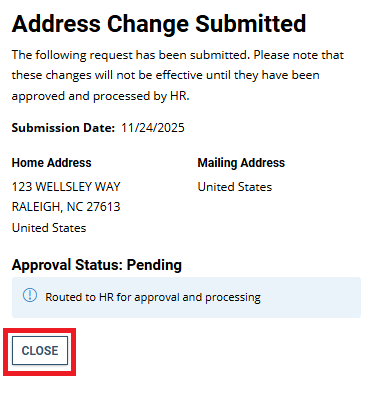

Important information

If your address change was associated with a change in your duty station (change to the city or state in which you work), you may need to update your benefits and/or tax withholdings.

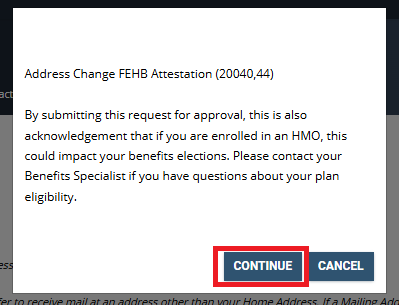

Benefits

If you are currently enrolled in a Federal Employee Health Benefits (FEHB) plan that is a Health Maintenance Organization type plan and you relocate outside of the geographic area from which the FEHB HMO carrier accepts enrollment, you may be eligible to change plans. You have 60 days after the loss of coverage to make this change. Contact your assigned benefits specialist for more information.

Tax Withholdings

- If your duty location change is within the same state, and you would like to

update the amount of your withholdings, you can make those changes in

Employee Express. - If your duty location change is to a new state, or to a city with locality tax,

download the appropriate IRS forms, and submit them to the National Payroll Branch

at kc-payroll.finance@gsa.gov.

If you have questions about this process, please contact kc-payroll.finance@gsa.gov.

GSA is unable to provide employees with tax or personal financial advice. As such, all

employees are recommended to consult a professional financial adviser or tax service

provider for assistance with making changes to their tax withholdings.

U.S. General Services Administration

U.S. General Services Administration