Our strategic goals are aligned with its four major program areas: real estate, acquisition, technology, and government operations. This summary includes an overview of key performance trends and insights for each of the four strategic goals. A complete analysis of our agency’s performance for this fiscal year will be included in the fiscal year 2023 Annual Performance Report, which will be published in February 2024.

Mission: To deliver the best customer experience and value in real estate, acquisition, and technology services to the government and the American people.

Strategic goal #1: Real estate solutions — Financially and environmentally sustainable, accessible, and responsive workspace solutions that enable a productive federal workforce

Strategic objectives

- Develop and offer integrated and virtual workspace options and services that maximize flexibility, particularly in anticipation of increased telework.

- Secure investments needed to achieve a right-sized and modernized portfolio that is safe, efficient, and affordable for customers.

- Establish and implement cross-cutting solutions that mitigate climate risks by increasing building resilience; reducing overall greenhouse gas emissions; improving energy, water, and waste efficiency; and supporting the transition to carbon pollution-free electricity.

- Identify and implement programs that positively impact local communities through enhanced economic activity and opportunities for underserved populations.

We lead the federal government’s real estate optimization efforts by offering new, innovative, sustainable, and flexible solutions that meet the varying workplace needs of customers. Critical investments in GSA-controlled facilities, consolidation of customers in federally owned facilities, and investments in climate adaptation and risk mitigation are the focal points of our real estate strategy. These efforts help us create a modernized and optimized footprint, reduce lease space, dispose of buildings that no longer meet standards of performance, and increase continuity of operations for customers and cost savings for the American public.

For real estate solutions, we achieved the FY 2023 performance targets for each of the key indicators shown in Table 1.

Table 1: Key performance indicators for real estate solutions| Measure | Status | FY 2023 target | FY 2023 results | FY 2022 results | FY 2021 results |

|---|

| Percent of CFO Act agencies with new National Workspace Portfolio Plans | Achieved | 80% | 100% | 50% | N/A |

| Percent of capital projects on budget | Achieved | 80% | 86.6% | 80% | 80.2% |

| “Good Neighbor Program” planning outreach and partnership engagements | Achieved | 33 | 39 | 22 | 5 |

An efficient real estate portfolio is crucial to providing safe, healthy, and functional workspaces for occupant agencies, while simultaneously delivering the best value to taxpayers. Our agency relies on several key practices to provide an efficient portfolio, including lease contract negotiations, effective space management, and project delivery assessment.

Supporting data from FY 2023 Capital Plan overview for CFO Act agencies

- 58% have identified reduction goals (sq. ft. and %).

Most plan to make changes in four to seven years. - 92% are interested in at least one workplace tool (WIL, Federal Coworking, Fast Track Space, etc.)

- 63% have projects in the works to reduce their spaces.

To promote more effective space management, we partnered with customer agencies to develop National Workspace Portfolio Plans with real estate strategies designed to meet customer needs and optimize their office space. These plans describe each agency’s current portfolio, real estate goals and strategies and opportunities for improving space utilization and reducing costs. We completed National Workspace Portfolio Plans for 100 percent of the targeted 24 CFO Act agencies in FY 2023. Our agency utilizes the information from these plans to help agencies achieve greater workplace efficiencies, as well as enhance its own ability to fully use federally owned assets, backfill or terminate vacant leased space, and dispose of surplus properties necessary to achieve an optimized portfolio. This should translate into reduced expenditures on federal real estate and greater customer satisfaction for agencies.

To assess and improve project delivery, we track capital projects on budget and capital projects schedule variance. In FY 2023, our agency’s percent of capital projects on budget exceeded the target, coming in at 86.6 percent. This indicator evaluates our agency’s ability to manage projects within the prospectus budget. Our performance demonstrates strong project planning, scope control, and budget management.

We also partner with local communities to better foster public use of its real estate holdings and support community based urban development. In FY 2023, we completed 39 outreach and partnership engagements as part of the Good Neighbor Program with local officials across the country. As part of this outreach program, we held community engagements across all Infrastructure Investment and Jobs Act Land Port of Entry major modernization projects. These engagements targeted communities where we planned future construction, modernization projects, major leasing activity, dispositions and communities where our existing portfolio had potential to support local sustainability, environmental justice, or other impactful planning goals.

Strategic goal #2: Acquisition — A modern, accessible, and streamlined acquisition ecosystem and a robust marketplace connecting buyers to the suppliers and businesses that meet their mission needs

Strategic objectives

- Ensure our portfolio of offerings meets market demand for products, services, and solutions and the desired acquisition approaches.

- Improve stakeholder satisfaction by delivering simplified customer- and supplier-centric experiences.

- As a trusted partner, foster the supply chain to support the agency and federal acquisition needs for 2025 and beyond.

- Aid U.S. economic growth by maximizing opportunities and minimizing barriers for small and/or underserved businesses seeking to do business with us.

We deliver value, innovation, and exceptional customer experience through efficient operations, market expertise, and proactive partnerships with customer agencies and private sector vendors. Technology is the cornerstone of our acquisition solutions, enabling the agency to improve the overall experience for buyers and suppliers. Our strategic position in the market, expertise, and relationships with customers and suppliers are driving equitable markets, sustainable practices, and continued economic growth.

For the acquisition goal, we achieved the FY 2023 performance targets for both of the key indicators shown in Table 2.

Table 2: Key performance indicators for acquisition| Measure | Status | FY 2023 target | FY 2023 results | FY 2022 results | FY 2021 results |

|---|

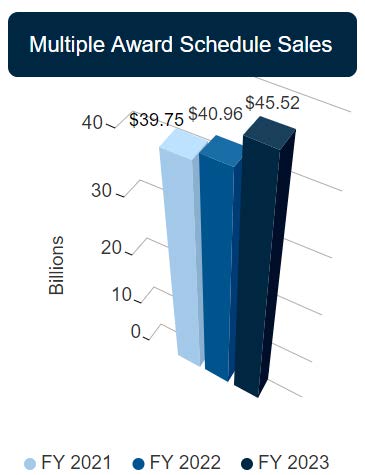

| Multiple Award Schedule sales (in billions)* | Achieved | $41 | $45.52 | $40.96 | $39.75 |

| Percent of spending going to small businesses from the Multiple Award Schedule | Achieved | 35% | 37.05% | 35.42% | 34.36% |

| * FY 2019 to FY 2021 results have been revised from previously reported figures. Extensive data cleaning and recoding led to a one-time revision as reported in our FY 2022 Annual Performance Plan and FY 2022 Agency Financial Report. |

Our agency uses the Multiple Award Schedule to issue long-term governmentwide contracts that provide federal, state, and local government buyers access to commercial products, services and solutions at pre- negotiated pricing. The MAS program makes it easier for suppliers to do business with the government and for agencies to find and acquire goods and services. In FY 2023, MAS sales totaled $45.5 billion. We use programs like set-asides and subcontracting plans so that a significant percentage of MAS business volume is awarded to small businesses, spreading government spending and opportunities across a broader group of suppliers. In FY 2023, the percent of spend awarded to small businesses from the MAS was 37.1 percent, which exceeded our performance target.

Strategic goal #3: Digital government — A digital government that delivers for the public through trusted, accessible, and user-centered technologies

Strategic objectives

- Implement inclusive, accessible, and equitable design practices that improve customer experience with technology and digital platforms.

- Lead governmentwide adoption of shared technology solutions that improve digital governance, sharing, security, and interoperability.

- Equip agencies with the knowledge and tools to strategically procure and deploy technology products and services.

Technology is critical to how every agency accomplishes its mission and serves the American public. We actively transform how the government uses technology by deepening governmentwide capabilities and developing more effective digital services to yield a trusted, accessible, and user-centered digital experience. We support customer agencies in their digital services journeys by providing common digital services and standards, shared platforms and products, while also improving our own websites, products, and services to showcase our offerings.

For digital government, we made strong progress towards our FY 2023 performance targets for each of the key indicators shown in Table 3.

Table 3: Key performance indicators for digital government| Measure | Status | FY 2023 target | FY 2023 results | FY 2022 results | FY 2021 results |

|---|

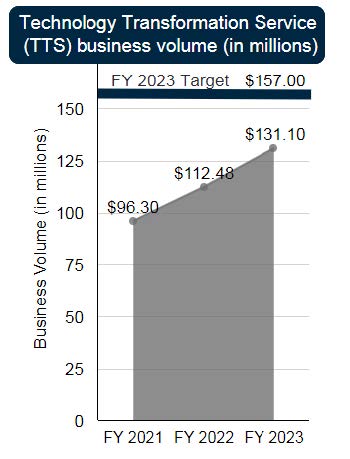

| Technology Transformation Service business volume (in millions) | Missed | $157 | $131.1 | $112.48 | $96.3 |

| Percent of Federal Citizen Services Fund’s American Rescue Plan funds that have been obligated (cumulative) | Missed | 78% | 69% | 35.23% | 2.2% |

| Number of times FedRAMP authorized products have been reused by agencies (cumulative) | Achieved | 5,353 | 6,318 | 4,573 | 2,864 |

Our Technology Transformation Services plays a crucial role within the federal technology ecosystem by providing valuable digital services and capabilities. TTS’s subject matter experts help federal agencies modernize their technology to deliver services more efficiently and equitably. We track business volume for TTS to gauge the demand for products and services across government and promote continued growth of the organization. In FY 2023, TTS business volume was $131.1 million. Despite missing the target set for FY 2023, this figure represents immense growth from FY 2022, increasing by nearly $20 million.

In the aftermath of the COVID-19 pandemic, Gwe received funding for the Federal Citizen Services Fund through the American Rescue Plan to build more secure and effective public digital experiences. By the end of FY 2023, we had obligated 69 percent of these funds. Despite falling short of the FY 2023 target, this percentage is nearly double what it was in FY 2022. By fostering ARP- funded technology initiatives across agencies, our agency continues to modernize government IT and provide trustworthy, seamless, and optimal experiences for the public.

Our agency’s Federal Risk and Authorization Management Program enables us to reduce digital threats governmentwide. FedRAMP is a standardized approach that enables agencies to adopt secure cloud technologies while complying with federal cybersecurity and information protection requirements. Reuse of FedRAMP-authorized products continues to increase at a steady pace with over 6,300 instances of reuse by the end of FY 2023, exceeding the target. By reusing FedRAMP-authorized products, the government is able to take advantage of economies of scale to generate savings and propagate a reliable security standard.

Strategic Goal #4: Government operations — A government that capitalizes on interagency collaboration and shared services to make informed management decisions and improve operations, delivering value for the American people

Strategic objectives

- Build evidence-based capacity and foster interagency collaboration to strengthen operational effectiveness at our agency and across government.

- Provide centralized services and shared solutions that promote cost savings and environmental sustainability, enabling agencies to focus on mission delivery.

- Deliver smart policies, regulations, and workforce training that inform management decisions and help agencies streamline operations.

Our agency plays a unique role in bringing together federal agencies, industry, academia, and subject- matter experts to make government more effective, efficient, and responsive to the American people. Our robust communication channels, processes, tools, and services collectively serve as an accelerator for sharing and applying knowledge across the executive branch. By strengthening decision-making capabilities, providing affordable and readily accessible solutions to operate key functions, and emphasizing healthy policy development and implementation practices, we enable customer agencies to execute their mission effectively.

For the government operations goal, we achieved the FY 2023 performance targets for both of the key indicators shown in Table 4.

Table 4: Key performance indicators for government operations| Measure | Status | FY 2023 target | FY 2023 results | FY 2022 results | FY 2021 results |

|---|

| Number of components advancing to the next stage of the standards governance process as part of the Federal Integrated Business Framework | Achieved | 18 | 83 | 32 | 36 |

| Percent miles per gallon improvement on vehicle replacements in the GSA leased fleet (agency priority goal) | Achieved | 23% | 37.1% | 25.29% | 18.49% |

When individual agencies use an in-house approach to provide services like financial management, grants management, procurement, and travel, the federal government misses opportunities to leverage economies of scale and expertise. The solution shared services is an industry best practice to improve the quality and performance of mission-support services in a manner that enables agencies to focus on their missions and better serve the American public, while also realizing cost and operational benefits.

When determining which services can be commonly shared across government, our agency utilizes a business standards governance process known as the Federal Integrated Business Framework. This process incorporates agency perspectives into establishing agreements on mission support business standards, enabling the government to make decisions on which services can be commonly shared. It consists of three stages: designated standards leads working directly with agencies to draft initial standards; cross-functional review by the Business Standards Council; and review and final concurrence on the part of OMB. In FY 2023, 83 components advanced to the next stage, exceeding the target.

Our agency’s fleet offering represents an opportunity to increase the use of centralized services across government while promoting climate-friendly solutions. The GSA Fleet program works to efficiently acquire and deploy vehicles in support of agency missions, increasingly through the procurement of zero-emission vehicles and electric vehicle charging infrastructure. These efforts accelerate the adoption of ZEVs across government, reducing greenhouse gas emissions and, ultimately, lowering the cost of operating motor vehicle fleets. In FY 2023, we significantly increased the number of ZEVs across government, thereby achieving a 37.10 percent increase in miles per gallon for vehicle replacements in the GSA leased fleet.

In the years ahead, our agency will continue to rely on interagency collaboration, shared services, and smart policies to deliver ever-more innovative, sustainable, and cost-effective solutions to the rest of government.

U.S. General Services Administration

U.S. General Services Administration