The financial statements and financial data presented in this report have been prepared from the our accounting records in conformity with generally accepted accounting principles, as prescribed by the Federal Accounting Standards Advisory Board.

Consolidated financial results

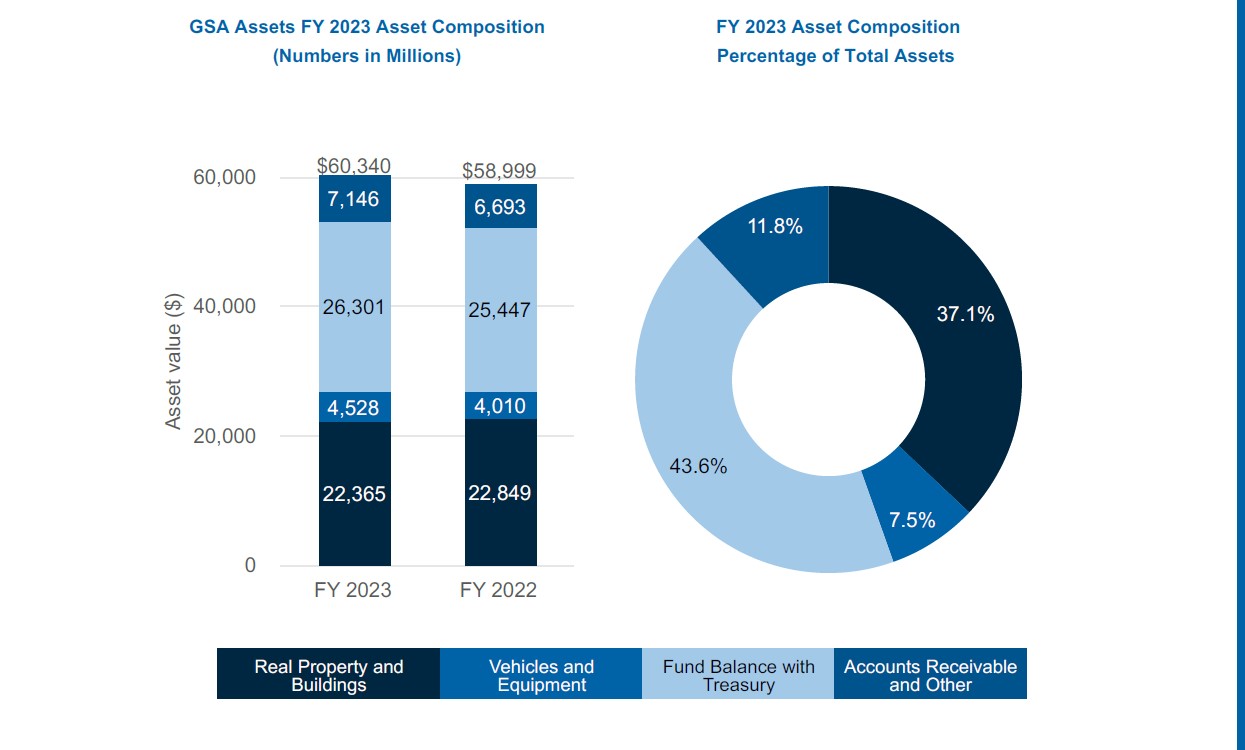

Our assets

GSA assets primarily include property and equipment, Fund Balance with Treasury and Accounts Receivable. The majority of property and equipment for GSA are federal buildings, motor vehicles, and office equipment. GSA accounts receivable are primarily derived from amounts due to GSA from federal agencies and non-federal customers for goods or services provided or uncollected rent.

In fiscal year 2023 GSA recorded a net increase of approximately $1.3 billion in assets. Significant changes in assets are attributable to an increase in the overall FBwT of $0.9 billion in the Federal Buildings Fund (FBF). Out of the $26.3 billion in FBwT, $8.7 billion is temporarily precluded from obligation by GSA. GSA’s accounts receivable from other Federal agencies increased by $463 million, principally due to increases in Acquisition Services Fund business volume.

Our accounts receivable from other federal agencies increased by $924 million, principally due to increases in Acquisition Services Fund business volume.

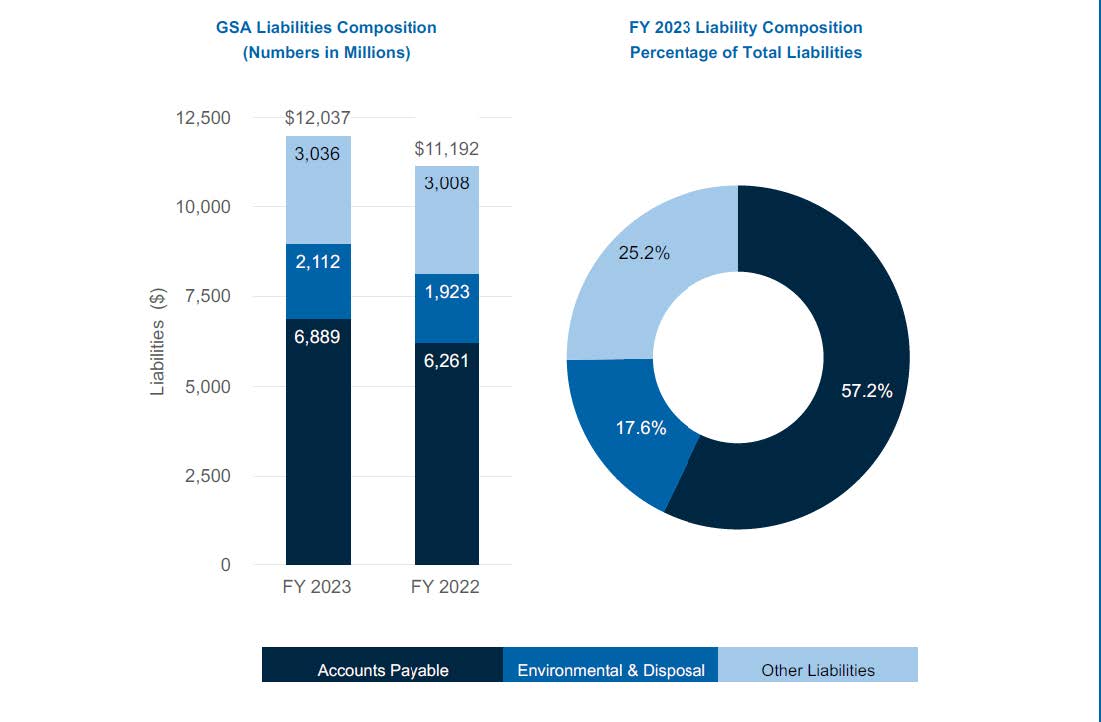

Our liabilities

GSA liabilities are primarily amounts owed to commercial vendors for goods and services received but not yet paid (Accounts Payable), amounts GSA owes to other Federal entities, and long-term estimates of future environmental remediation costs.

In FY 2023, total liabilities were $12 billion, a net increase of $845 million compared to FY 2022 total liabilities of $11.2 billion. The increase in accounts payable is comparative to the increase in accounts receivable and also attributable to increased business volume in the ASF.

Our net results

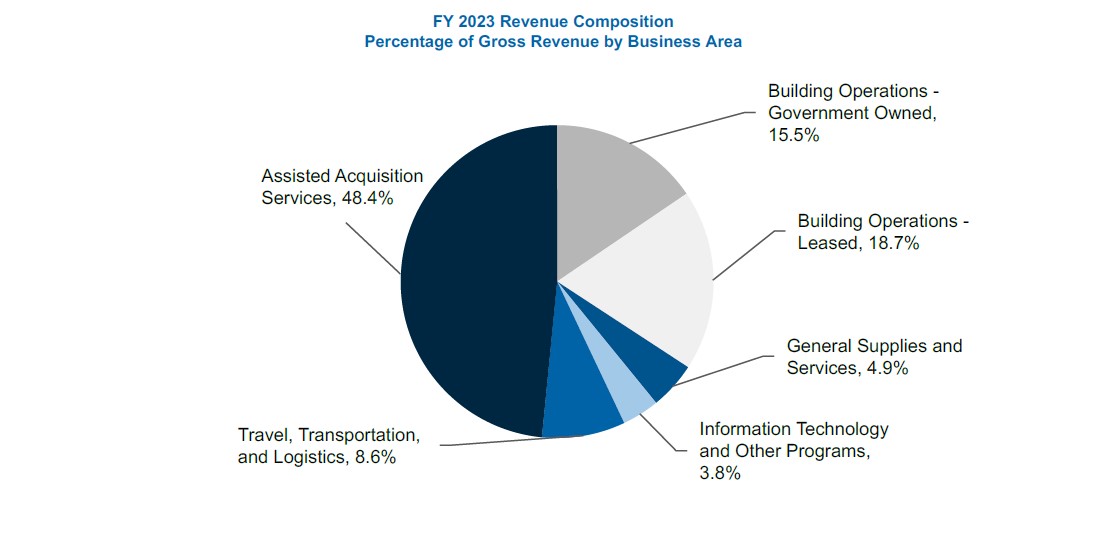

The Consolidating Statements of Net Cost present the revenues and expenses incurred by providing goods and services to GSA’s customers and executing GSA’s programs, displayed by major components and activity. GSA reported approximately $34.7 billion in revenue during FY 2023 compared to $32.4 billion reported in FY 2022, which were matched by expenses of $34.6 billion and $31.9 billion, respectively. Changes in the FBF and ASF net operating results are presented further below.

Table 1. Revenue by major business line (dollars in millions)

| Fund

|

Major business line

|

FY 2023

|

FY 2022

|

Dollar change

|

Percentage change

|

| ASF

|

Assisted acquisition

|

$16.872

|

$15,017

|

$1,855

|

12.4%

|

| ASF

|

Travel, transportation and logistics

|

$3,001

|

$2,692

|

$309

|

11.5%

|

| ASF

|

General supplies and services

|

$1,710

|

$1,345

|

$365

|

27.1%

|

| ASF

|

IT

|

$1,710

|

$1,295

|

$(260)

|

(20.1)%

|

| ASF

|

Professional services and human capital

|

$133

|

$116

|

$17

|

14.7%

|

| ASF

|

Other programs

|

$168

|

$203

|

$(35)

|

(17.2)%

|

| FBF

|

Building operations - Government owned

|

$5,402

|

$5,334

|

$68

|

1.3%

|

| FBF

|

Building operations - Leased

|

$6,516

|

$6,561

|

$(45)

|

(0.7)%

|

| This table shows gross revenue by our major business lines. It does not include appropriations or funding transferred within our agency. (See the Consolidating Statement of Net Cost for details.)

|

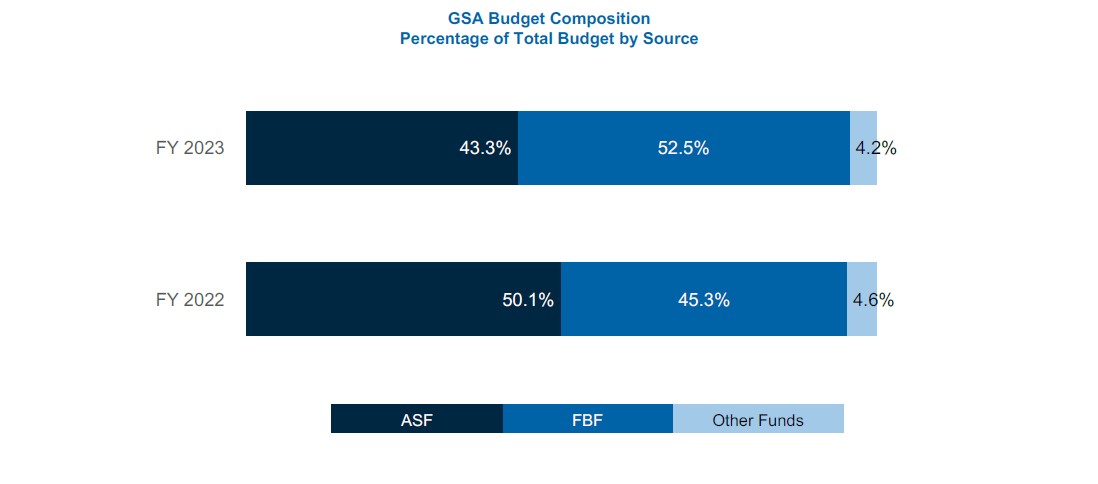

Our budget

GSA’s Total Budgetary Resources, reported on the Statement of Budgetary Resources, realized a net increase in FY 2023 by $5.1 billion primarily due to increases in spending authority from offsetting collections and obligations in the ASF. Generally this type of spending authority is created by the revenues and customer orders received from Federal agencies and is also referred to as reimbursable spending authority. The ending unobligated balance increased by $730 million, primarily related to unobligated brought forward balances in the FBF from prior year appropriations.

Table 2. Budget by fund (dollars in millions)

| GSA fund

|

FY 2023

|

FY 2022

|

Dollar change

|

Percentage change

|

| Acquisitions Services Fund

|

$30,913

|

$26,933

|

$3,980

|

14.8%

|

| Federal Buildings Fund

|

$25,482

|

$24,350

|

$1,132

|

4.6%

|

| Other funds

|

$2,502

|

$2,473

|

$29

|

1.2%

|

| Total budget

|

$58,897

|

$53,756

|

$5,141

|

9.6%

|

U.S. General Services Administration

U.S. General Services Administration