Financial results by major fund – Federal Buildings Fund

The FBF is the primary fund established for financial administration of Public Buildings Service activities. PBS provides workplaces for federal agencies and their employees. FBF resources are primarily generated by rent paid to GSA by other federal agencies. Operating results are displayed on the Consolidating Statements of Net Cost, segregated into two primary components of Building Operations – Government owned, and Building Operations – Leased.

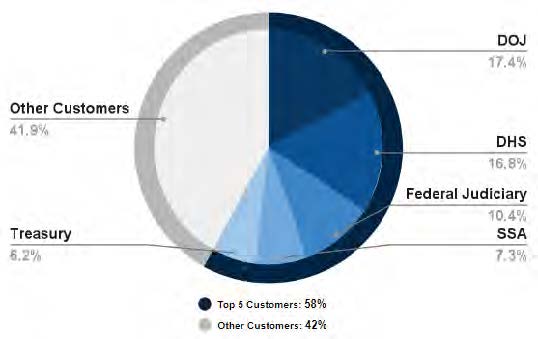

In FY 2022, FBF gross revenue was over $11.9 billion, with over 58 percent of the revenue generated from PBS’s top five federal customer agencies as shown in Table 3.

Table 3. FBF customers (dollars in millions)

| Customers

|

Revenue

|

Percentage of total revenue

|

| U.S. Department of Justice

|

$2,066

|

17.4%

|

| U.S. Department of Homeland Security

|

$1,992

|

16.7%

|

| Federal Judiciary

|

$1,236

|

10.4%

|

| U.S. Social Security Administration

|

$869

|

7.3%

|

| U.S. Department of the Treasury

|

$736

|

6.2%

|

| All other customers

|

$4,996

|

42.0%

|

| Total

|

$11,895

|

100.0%

|

The above gross revenue is inclusive of reimbursable income.

FBF net revenue from operations

FBF Net Revenue from Operations represents the amounts remaining after PBS’s costs of operating federally owned and leased buildings are subtracted from revenue. Net Revenue from Operations generates funding to support investments in repairs and alterations for federal buildings and to provide funding for the cost of constructing new federal buildings, subject to appropriation to the FBF enacted by Congress.

The primary source of revenue in the FBF is rent earned from our occupant agencies and the primary source of expenses are the cost of leasing building space and the cost of operating our portfolio of federally owned and leased buildings. PBS also operates a reimbursable work authorization program, which provides occupant agencies with services and improvements in our space, beyond what we provide in exchange for the payment of rent.

The operating results on the Statements of Net Cost demonstrate consistency in the overall state of the real property portfolio. In FY 2022, FBF revenues slightly decreased by 0.1 percent from FY 2021 resulting in a $364 million reduction in net revenues from operations primarily due to a 3.2 percent increase in expenses.

FBF obligations and outlays

In the FBF, obligations are primarily the value of contracts awarded to commercial vendors for the construction of new federal buildings, repairs and alterations, cleaning, utilities and other maintenance of our federal buildings. Obligations are also incurred for payments to commercial landlords for space we lease on behalf of other federal agencies. Obligations incurred in FY 2022 reflect decreases in total program activity. Generally, changes in net outlays reflect a continuing trend of collections from operating revenues exceeding amounts disbursed for operating and capital programs.

Table 4. FBF obligations and outlays (dollars in millions)

| Obligations and outlays

|

2022

|

2021

|

Dollar change

|

Percentage change

|

| New obligations and upward adjustments

|

$11,230

|

$11,356

|

$(126)

|

(1.1)%

|

| Net outlays (receipts) from operating activities

|

($982)

|

($965)

|

$(17)

|

1.8%

|

U.S. General Services Administration

U.S. General Services Administration