Civilian Services Acquisition Workshops

Enabling Agencies to Write Better Requirements & Acquisition Strategies

The CSAW Program is providing resources to help agencies develop and deploy better written, performance-based requirements to achieve more efficient and effective contracts for services.

Utilizing the Steps to Performance-Based Acquisition, you can achieve better performance outcomes at reduced costs. Below you will find innovative tools and resources to help you through the planning phase of the acquisition process.

One key resource is the COE Intake Form [DOCX - 537 KB]. Completing this form will give the Center of Excellence for Outcome-Based Contracting a picture of where you are in the service acquisition process, so they can provide more tailored support. It also helps project teams gather critical information to guide their work throughout this process.

Check out this CSAW Frequently Asked Questions document [PDF - 219 KB] to learn more.

Each section below presents a useful tool or technique, including: an overview of the topic, how to use the tool or implement the technique, and (in most cases) a resource to help you do it. If you need help or have feedback, please contact csaw@gsa.gov.

Setting Objectives for the Acquisition Team

- Overview: When first meeting as an integrated project team, it is important to understand everyone’s roles and purpose for being involved in the project. One helpful way of approaching this is by understanding each group member’s personal objectives and concerns, and then identifying key themes or issues that may need to be addressed.

- Revisit the list throughout the procurement lifecycle or at the end of a facilitation event to ensure that their initial goals/concerns have been met.

- Technique: Personal Objectives/Concern

- Each participant should reflect on the project as they understand it and their role, and then write at least one objective and one concern about the project, the work that needs to get done, or anything else important to them that they would like to see addressed, on a sticky note.

- Each objective or concern should be on its own sticky note (so they can be moved or grouped later)

- Give them about 2 minutes

- Optional: you can choose to have participants add their name or not depending on the circumstances

- Collect the sticky notes and discuss each item as you place them on a flip chart labeled “Personal Objectives”.

- You do not need to transcribe the Sticky Notes to the Flip Chart - you may just place the sticky notes on the chart as you discuss them

- This can easily be combined with introductions

- Each participant should reflect on the project as they understand it and their role, and then write at least one objective and one concern about the project, the work that needs to get done, or anything else important to them that they would like to see addressed, on a sticky note.

- Virtual Consideration: If conducting virtually, screen share the slide (or a document), where you record everyone’s objectives/concerns. If using Zoom (and depending on agency security protocols), you can create a whiteboard and instruct the participants to put a sticky note for both their personal objective and concern.

Current State Analysis

- Overview: A current state analysis is a great way to identify what is and what is not working in the current environment (including the current contract, if applicable) and apply these insights to development of the new requirements.

- Technique: This technique is written for an in-person facilitation, but can be adapted for use in a virtual environment using chat, virtual whiteboards, and/or slides.

- Preparation: The team will answer four questions:

- What is working well today that you want to keep doing (aka maintain status quo)?

- What is working well today that you want to do more of (aka amplify best practices)?

- What is something that you would like to do less of or stop doing?

- What is something that you’d like to do differently?

- Preparation: The team will answer four questions:

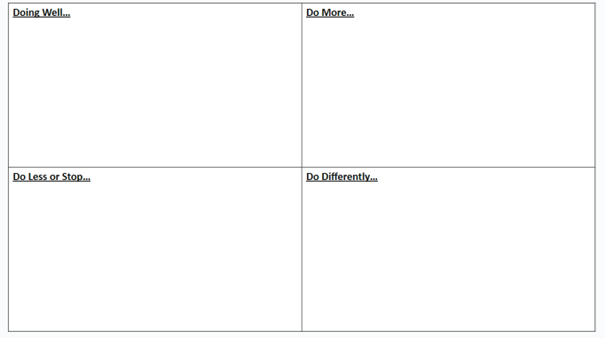

- On a large sticky flipchart, create four quadrants and label them: Doing Well, Do More, Do Less/Stop, and Do Differently. Create one flipchart for each small group. See the diagram below:

- Phase One: Individual Time (about 5min):

- Each person will individually brainstorm on sticky notes with black sharpie pen, answering all four questions. One response per sticky note. They can write as many responses as they like with multiple responses to each question.

- Phase Two: Small Groups (about 10min)

- Separate the group into smaller groups of 3-4 people

- Then each group will share/discuss their individual responses and put them on their group’s flipchart and will select someone to report out their flipchart with the larger group.

- If there are duplicate/similar individual response, the groups should stick them together and put them on the flip chart

- If there are disagreements or responses that do not fully fit into a quadrant, they can put them in between the two quadrants for discussion later.

- Phase Three: Large Group (about 20min)

- As a large group, have one member from each group report out their responses and discussions and facilitate a larger discussion with the group as needed.

- Facilitator Resources:

- Prompts: consider some of these questions to help guide the conversation

- Are there similar responses across teams? Major differences?

- Do some groups have the same response in a different quadrant? Why?

- How would you do things differently?

- What is preventing you from doing something more/less/differently?

- What would need to change to do that?

- Best Practice: rotate from group to group, collecting one response per team to keep the whole group engaged

- Insights/Best Practices:

- The quadrant/sticky note activity is a great exercise for brainstorming, however the most value tends to be the ensuing discussions across the team from the lists generated. If you find the team not having particularly rich discussions from the activity, the facilitator should consider using probing questions to initiate discussions.

- Prompts: consider some of these questions to help guide the conversation

Gaining Team Consensus on a Vision and Mission

- Overview: As an IPT moves through the acquisition strategy process it is important that all team members have consensus on major decisions. Building consensus can be challenging, but we believe that consensus is not a simple majority decision. Consensus is unanimous and therefore it is powerful.

- Defining Consensus: Group consensus means that everyone agrees that they can “live with the decision, and that they will support it.”

- We use a consensus check technique called “Five Finger Consensus Check,” where participants are asked to show their level of agreement using the fingers on their hand. Here’s how we define each level:

- 5 - I’m completely bought in and will fully champion this

- 4 - This is really good and I’m fully on board

- 3 - I can live with this and I will support it

- 2 - Something’s not quite there for me and I don’t know if I can live with it or support it

- 1 - I am absolutely opposed to this and need a significant change to get onboard

- Sometimes, before you can start taking consensus checks, you need to do some work defining the language that you’re seeking agreement on - this is especially important for Vision and Mission statements, but can be used in multiple applications.

- Technique: The Informed Majority Technique is a way to help teams develop fundamental pieces of text, such as a Vision or Mission statement, while working through multiple iterations or suggestions on the wording, content, or even grammar.

- Start with individual contributions by giving time for each person to list out keywords or phrases for the topic (ex. Vision Statement)

- Collect all the individual responses and then divide into groups to tackle writing the draft statement. Provide each group with the individual responses and a flipchart to record their draft statement

- Then, follow the instructions in the Informed Majority Technique (linked below) to facilitate getting to the final language

- Make sure to do a consensus check around the final language and if everyone is at a three or higher, you’re golden. If there are any one’s or two’s, ask them for the “one thing” that needs to change for them to get to a 3 or higher.

- Resource: Informed Majority Example [DOCX - 14 KB]

Writing Better Requirements Using the ARC Method

- Overview: Conventional approaches to writing requirements can lead to ambiguity, confusion, and a lack of important contextual information about the nature and scope of the envisioned work. In turn this can lead to unwanted and inefficient outcomes such as poor performance, increased costs, and time-consuming contract modifications.

- Technique: Use the ARC Method (Action, Result, Context) to simplify writing your requirements and make them more effective.

- Start with the Result: what are the deliverables or outcomes that you need in a particular scope area? List them out

- Determine the Action associated with the Result: are you asking the contractor to “create” a project plan, “revise” a project plan, or “execute” a project plan? Each action has different performance standards.

- Finally, your vendor will need Context: what additional information is critical to understanding the Action and Result? What organization is doing the projects and what are they for? How many projects are there?

- Example:

- C.4.2.1 The Contractor shall draft meeting read-aheads with inputs gathered from key government personnel.

- The Result is “meeting read-aheads”

- The Action is “draft”

- The Context is “with inputs from the government”

- Every ARC Statement begins with “The Contractor shall” or “The Contractor must” - choose one of these and stick with it throughout the document.

- Resources: both of these documents work the same, but some people prefer to work in a document, and others prefer a spreadsheet. We have found that more people like the spreadsheet, but use whichever one makes the most sense for your organization. Detailed instructions on how to best use the Worksheet and Spreadsheet can be found in the respective documents.

Performance-Based PWS Concept: Template

- Overview: The three main documents used for procurements to capture their scope are the SOW, PWS & SOO. A PWS or Performance Work Statement is the recommended format for performance based acquisitions. Statements of Work (SOW) and Statement of Objectives (SOO) are also common requirements documents. Below is a description of each, along with a template of a performance-based PWS.

- Performance Work Statement (PWS) - PREFERRED

- Focus: Describes the required results with performance standards, not how to do the work.

- Detail Level: Focuses on outcomes, performance metrics, and quality levels.

- Contractor Role: Contractor has more freedom to determine the best way to achieve the desired results.

- Use Cases:

- Projects where the desired outcome is clear, but the best method to achieve it may be unknown or best left to the contractor’s expertise.

- Services where performance can be effectively measured.

- Examples:

- Call center services, where metrics like average handle time and customer satisfaction are key.

- Landscaping services, where the desired outcome is a well-maintained landscape, but the contractor determines the specific methods.

- Statement of Work (SOW)

- Focus: Describes how the work should be accomplished, along with specific tasks, deliverables, and timelines.

- Detail Level: Highly detailed and prescriptive, leaving little room for contractor interpretation.

- Contractor Role: Contractor is closely managed and follows specific instructions.

- Use Cases:

- Projects with well-defined processes and methodologies.

- Situations where the government has specific technical expertise and wants to dictate the approach.

- Example:

- Construction projects where materials, methods, and steps are precisely laid out.

- Statement of Objectives (SOO)

- Focus: Outlines the high-level objectives and purpose of the project.

- Detail Level: Least detailed, providing only a broad overview of the desired end state.

- Contractor Role: Contractor has the most freedom and responsibility to propose a solution and define the specific tasks and deliverables.

- Use Cases:

- Complex projects where the buyer is seeking innovative solutions and wants to encourage contractor creativity.

- Research and development projects where the exact path forward is uncertain.

- Examples:

- Developing a new technology to address a specific problem, where the contractor proposes the research approach and development plan.

- Designing a new marketing campaign to reach a target audience, where the contractor proposes the creative concept and execution strategy.

- Resource: Performance Based Performance Work Statement (PWS) Concept Template [DOCX - 15 KB]

Getting More from Market Research

- Overview: Market Research is a core process in any procurement. An important function of market research is the attempt to find answers to questions relevant to the requirements being developed and the results envisioned. Often times adequate time is not spent by IPTs on development of a market research plan - specifically identifying a wide landscape of questions relating to the requirements, the answers of which would greatly aid in the

- Technique: Questions, Questions, Questions Instructions

- Setup: Get the IPT together for a brainstorming/data dump exercise - if it is a larger group (10+ people, consider breaking the group into smaller groups of 3-4 people per team).

- Prompt: In a perfect world with unfettered access to any information you want, what questions would you ask if you were guaranteed to receive an answer? If you could get any answer to help make your acquisition process better, what questions would you ask? Questions are not limited to potential vendors - absolutely anyone (industry, other government agencies, your own agency, etc.).

- Give the group 7-8 minutes to brainstorm any and every question that comes to mind. The goal is not to discuss or debate the question during this time, the goal is to get as many questions down as possible in the allotted time.

- Documenting Results:

- Once time is up, compare and discuss the team(s) questions.

- Have any questions been asked previously? What was the result? What were the roadblocks preventing the question? Are there any strategies for overcoming the roadblocks?

- Keep in mind some questions can be asked to multiple sources if the phrasing or context is tailored to a specific source. Here are some examples:

- “What innovations in survey collections have been achieved recently” could be asked to vendors and industry that focus on surveys as well as government agencies known for data collection like the Census Bureau or Bureau of Labor Statistics.

- “How should the contractor be evaluated for performance?”. You can ask internal sources such as government agencies or internal program sources to identify critical performance factors. These entities may have historical lessons learned insights that could inform your acquisition planning. You can also ask prospective vendors how they should be evaluated to gain key insights as to what they determine to be critical issues or potential pain points that may require additional attention as a performance metric. These sources have different and valuable perspectives that should be considered when determining performance factors.

- Go back through the list of questions and annotate which source(s) should be asked this question.

- Decide on realistic, pertinent, and valuable questions that need to be asked, then develop a plan (and deadline) to pursue the answers to questions to the source(s) identified. It may be helpful to assign questions to individuals or small groups of the IPT to ensure follow-through.

- KEEP A LIST OF ALL QUESTIONS GENERATED. You may need to revisit this list throughout the market research phase. Keep adding to the list as you continue to work on the acquisition.

- Once time is up, compare and discuss the team(s) questions.

- Setup: Get the IPT together for a brainstorming/data dump exercise - if it is a larger group (10+ people, consider breaking the group into smaller groups of 3-4 people per team).

- Resources: It can be helpful to cover some common myths related to market research to help the team figure out how to seek answer to their new list of questions, here are some helpful resources:

Stakeholder Identification and Analysis

- Overview: Understanding stakeholder investment in a project is critical, oftentimes to the point of whether or not a project will come to fruition. Internal and external stakeholders can be analyzed based on five criteria split into two groups: power and interest. Understanding how each stakeholder group fits into each of these criteria can better equip teams to manage them. Below is a worksheet for capturing each stakeholder group and analyzing them.

- Technique: Conduct Stakeholder Identification and Analysis

- First, work with the acquisition team to identify any and all stakeholders that might have interest, involvement, or influence in the overall acquisition.

- Next, for each stakeholder identified, conduct a simple analysis of their level of Power and Interest

- Power is comprised of two elements: Influence and Importance

- Influence: Indicates a stakeholder’s relative power over and within a project. A stakeholder with high influence would control key decisions within the project and have strong ability to facilitate implementation of project tasks and cause others to take action.

- Importance: Indicates the degree to which the project cannot be considered successful if stakeholder needs, expectations, and issues are not addressed. This measure is often derived based on the relation of the stakeholder’s need to the project’s goals and purposes. The users of the project’s product or service typically are considered of high importance.

- Interest is comprised of two elements: Commitment and Engagement

- Commitment: Indicates the stakeholder’s current level of commitment to the project’s success. High commitment demonstrates a strong buy-in to the project, whereas low commitment is likely an indication of resistance to the project.

- Engagement: Indicates the level of involvement of the stakeholder in the project. High engagement may be indicated for stakeholders who are either regularly involved in project matters OR have a strong desire to be regularly involved in project matters.

- Sometimes it is also helpful to assess a stakeholder’s relative Knowledge: What is the current level of knowledge and understanding of what the program is and what it can do for the stakeholder and their organization.

- For each element, have the team collectively rate the level on a scale of High, Medium, and Low. We often use thumbs up, thumbs down, or thumbs in the middle to quickly have everyone rate each element. If there’s a lot of variation, have some discussion around the different ratings and then try to get closer to a consensus.

- The worksheet will combine the sores to show you where they fall on the stakeholder management chart. Then, as a team, choose a communication strategy to target your stakeholders to effectively increase buy-in and support for your project.

- Resources: Stakeholder Analysis Worksheet [XLSX - 426 KB]

Civilian Services Acquisition Workshop Approach

- Overview: The Civilian Services Acquisition Workshop (CSAW) is a facilitated workshop built around a specific acquisition and a multi-functional integrated project team, or IPT. It is designed to help teams more effectively and efficiently develop or refine their contract requirements and their acquisition strategy.

- The workshop walks the complete team through the Steps to Performance-Based Acquisition (PBA) process from beginning to end.

- CSAW Purpose: Develop the vision, mission, high-level objectives, performance requirements, measurable standards, and performance-based strategies for the agency requirement and a roadmap to complete it.

- Technique: CSAWs get all members of the acquisition team or IPT for up to a week, where they contribute and work together to achieve the CSAW Purpose.

- The workshop focuses on getting actual work product started, creating shared understanding and clarity about the work left to do, and giving the team the tools to continue the process through to completion together.

- Resource: Below is a link to the full workshop deck. It houses content for multiple types of requirements, from traditional PBA to Agile software development and SOO use. While it is available for our community to use, CLPs can only be delivered to participants that attend a CSAW led by a certified CSAW Facilitator.

U.S. General Services Administration

U.S. General Services Administration